2020.04.24

Property Owners: Should I sell or should I buy? Let’s evaluate separately according to the data of newly-built and pre-owned houses

Sell or not to sell? Buy or not to buy? A common question that people often wonder if there’s an absolute answer to it. This time, we would like to elaborate the topic based on the data analysis about newly-built and pre-owned houses for your reference.

TOC

1. Sales of new houses

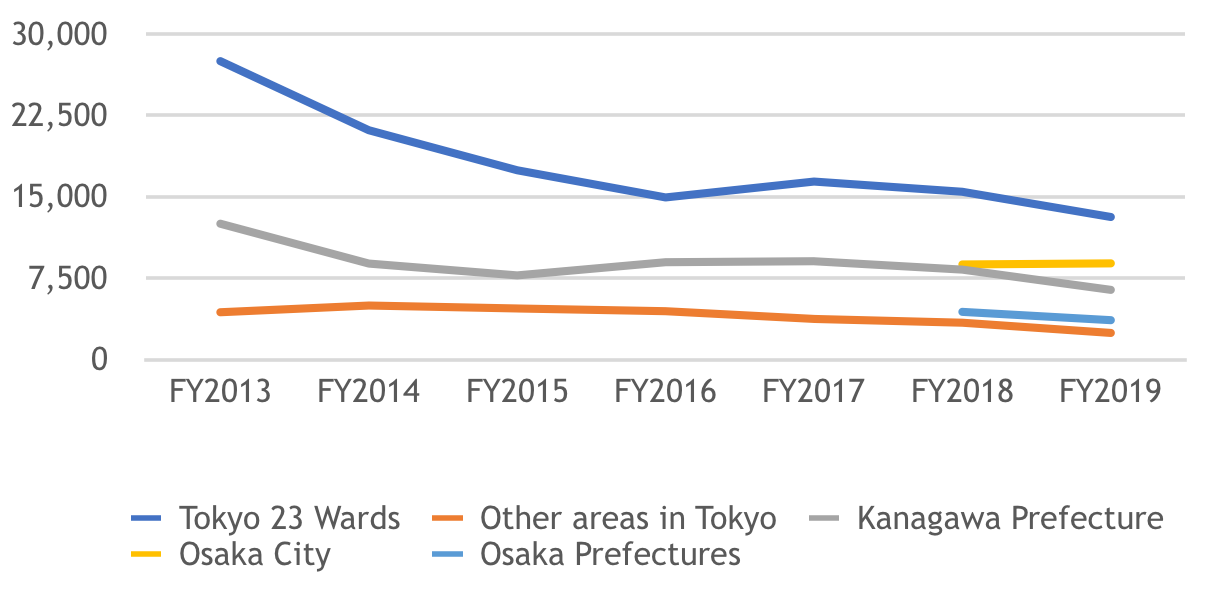

According to the figures released by the Real Estate Economic Research Institute Co., Ltd., compared with the previous year, the number of new house supply in 2019 decreased by 15% in 23 Wards of Tokyo, 28% in other areas of Tokyo, 28% in Kanagawa Prefecture, 1% in Osaka City, and 17% in Osaka Prefectures. In general, the numbers dropped substantially. Considering the impact of the CONVID-19 outbreak, the numbers are expected to decline more in the short term.

Figure 1. The number of new house supply

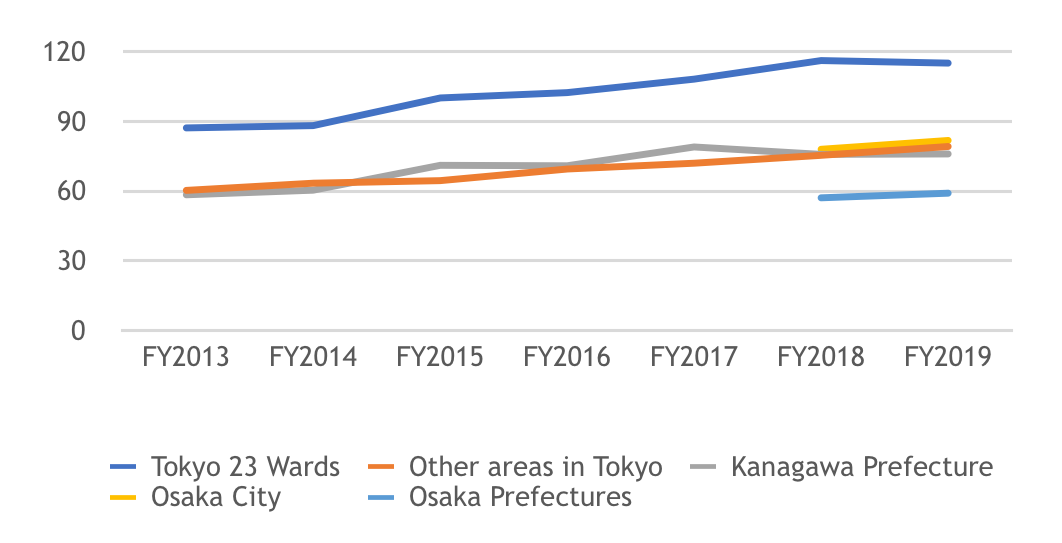

The price per square meter of new houses is shown in Figure 2. Compared with the previous year, the number in 23 Wards of Tokyo decreased by 1%, in other areas of Tokyo increased by 5%, in Kanagawa Prefecture no changes, in Osaka City increased by 5%, and in Osaka Prefectures increased by 4%. Most of the numbers increase slightly and the main reason for the increasing selling prices is the correlated increasing construction costs. As shown in Figure 1, the current reduction in the number of new house supply is also somewhat related.

Figure 2. The selling price of new houses (10 thousand JPY per square meter)

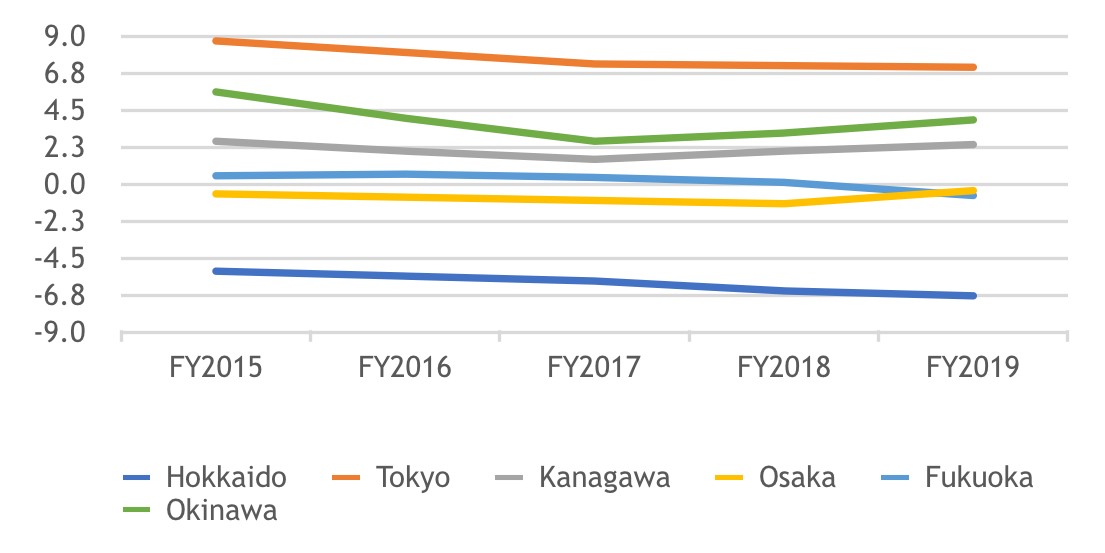

As mentioned above, the price per square meter in Tokyo and Osaka Prefecture has risen but the price in Kanagawa Prefecture hasn’t changed much. Figure 3 presents the population growth rate announced by the Statistics Bureau of Japan. The population growth rate in Tokyo was 7.1%, same as it in the previous year, and the growth rate in Kanagawa Prefecture was 2.4%. This may help explain why the price per square meter is increasing. In addition, the population of Okinawa increased by 3.9% but the population of Hokkaido decreased by 6.8%. These two changes also deserve special attention.

Figure 3. Prefectural population growth rate (October 1 of each year)

The overall decreasing number of the new house supply in Tokyo, Kanagawa, and Osaka is expected to be decreasing even more due to the impact of CONVID-19. On the other hand, assuming that the high growth rate of Tokyo ’s population is not possible to change suddenly, the price per square meter will rise in the long run. Same, the number of supply in Kanagawa Prefecture should also change from flat to a slight increase. In addition, the great population growth in Okinawa and the correlated future price trend is worth paying attention to.

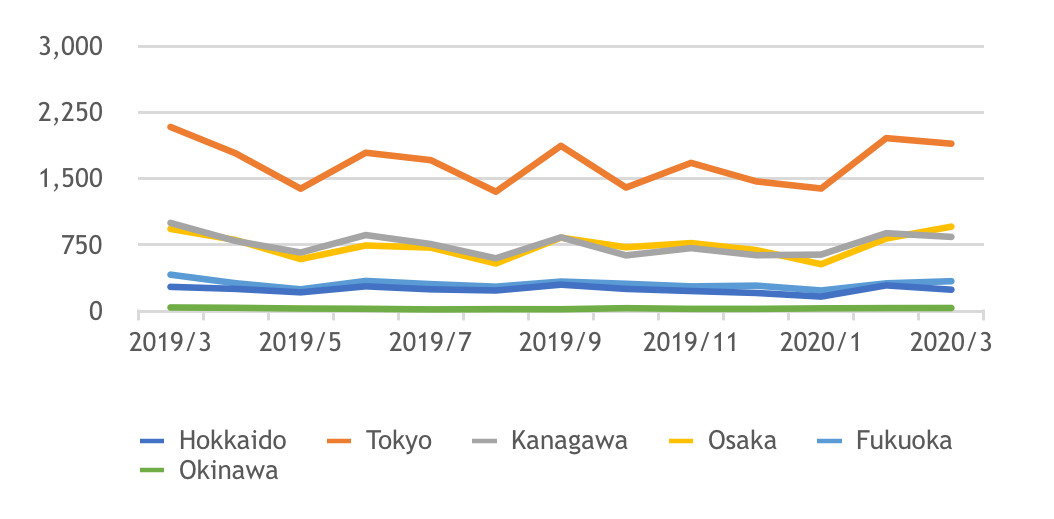

2. Sales of pre-owned houses

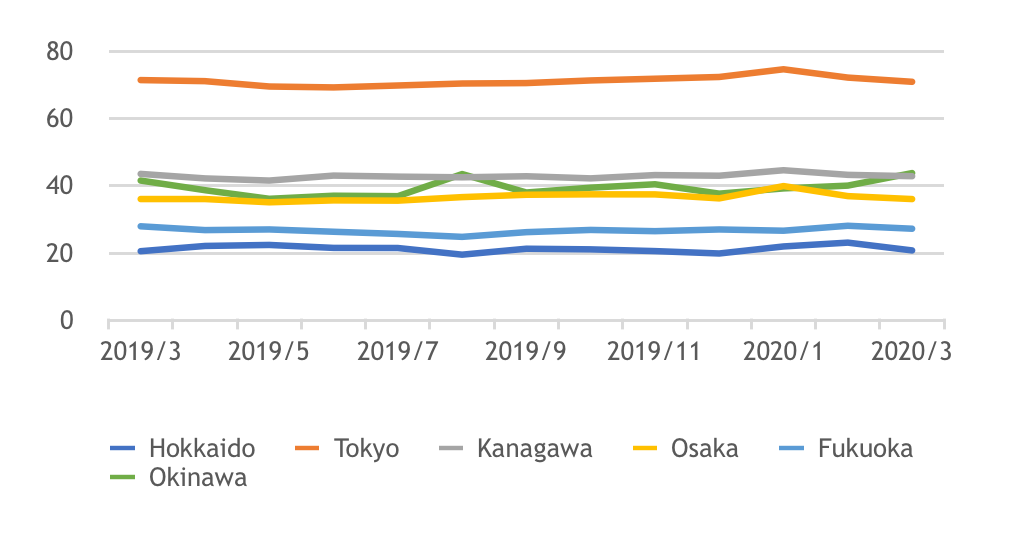

Next, let’s take a look at the sales for pre-owned houses. The transaction amount of pre-owned houses in the past year provided by the Real Estate Transaction Promotion Center is shown in Figure 4. In March 2020, the sales in major cities except Osaka decreased: 13% decrease in Hokkaido, 9% decrease in Tokyo, 16% decrease in Kanagawa, 3% increase in Osaka Prefecture, 18% decrease in Fukuoka Prefecture, and 14% decrease in Okinawa Prefecture. It’s doubtful that if the decrease is caused by the impact of CONVID-19. However, in the short term, the transaction amount should continue to decrease.

Figure 4. The transaction amount of pre-owned houses in the past year

The change in selling price per square meter is shown in Figure 5. Compared with the previous month, in March 2020, the price in Hokkaido rose by 1%, in Tokyo fell by 1%, in Kanagawa Prefecture fell by 2%, in Osaka Prefecture remained flat, in Fukuoka Prefecture fell by 3%, and in Okinawa Prefecture rose by 5%. Assessed together with the population increase of Okinawa Prefecture shown in Figure 3, the selling price per square meter in Okinawa Prefecture should increase in the long run. On the one hand, although in Tokyo and Kanagawa Prefecture the prices per square meter are falling due to the impact of CONVID-19 in short term, considering the expected increase in population in the future and the reduction in new house supply in a certain period of time, the amount of house will be in short supply. Inconclusion the selling price should not continue to decline.

Figure 5. The selling price of pre-owned house (10 thousand JPY per square meter)

Even though in the countermeasures the Japanese government is drafting regarding CONVID-19 includes the related policy to deal with delayed rent payment, the real estate prices may not necessarily fall. To sell or to buy? Given the basic population increase and future demand, there may not be an absolute answer to the question. The thing we need to do is to keep watching the market and the related figures and find the right timing to make the best transaction.