2021.11.15

Tax Implications Chapter 1. Owning a Property in Japan

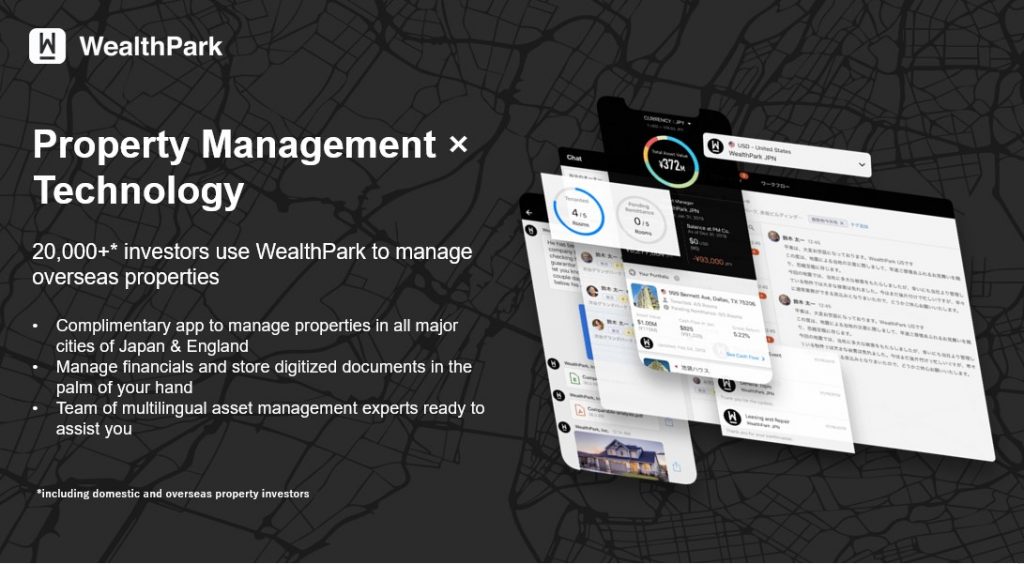

WealthPark has been striving to assist Asian investors in managing their property investments in Japan, providing a comprehensive package of high-quality asset management services including tax consulting and filing. Before introducing WealthPark’s tax services, let us understand what kind of taxes need to be considered when investing in Japanese properties.

In Chapter 1, we will first look into the tax aspects of owning and letting a property in Japan. Generally, there are three types of taxes: Withholding Tax on Rental Income, Fixed Assets Tax, and City Planning Tax.

TOC

Withholding Tax on Rental Income

Overseas property investors are obligated to file tax returns for their investment income earned in Japan every year. The taxable amount is the net rental income after deducting management fees, reserve funds for repair, maintenance costs, and other rental expenses. If the taxable amount is below JPY200,000, usually investors do not need to pay the withholding tax.

Please note that in the case when the tenant is a corporate entity or sublease or the purpose of property use is for business, the tenant is required to pay 20.42% of the rent as withholding tax and pay the rest (79.58%) to the owner. Part or all of the withholding taxes can be refunded by filing a tax return.

Click here to view the withholding tax table

Fixed Assets Tax

Fixed assets consist of land and properties. Overseas investors are required to pay fixed assets tax based on the valuation of both land and properties on January 1 of each year. The tax rate is 1.4%, thus the tax amount is the valuation of fixed assets x 1.4%. Local governments in Japan are responsible for the valuation assessments of fixed assets that are held every three years. Roughly speaking, the valuation of fixed assets is about 70% of the market value at the time of assessment. The ultimate valuation results will vary subject to the size, structure, and age of each of the fixed assets. The valuation details of fixed assets are provided on the annual tax notice. In addition, the tax base for residential land is reduced depending on the size of the land; residential land of 200sqm or less is defined as “small residential land” and the tax base is one-sixth of the valuation; residential land other than small residential land is defined as “general residential land” and the tax base is one-third of the valuation.

City Planning Tax

In Japan, city planning areas refer to urbanization promotion areas that have been urbanized or will be urbanized in about 10 years. Investors who own properties located in these areas are required to pay city planning tax. The tax rate is set by the local governments with the upper limit of 0.3%, thus the tax amount can reach up to the valuation of fixed assets x 0.3%.

WealthPark provides tax representative services for overseas investors to help them handle matters related to the payment of fixed assets tax and city planning tax in Japan. Besides, WealthPark also introduces affiliated tax accountants who offer income tax filing services. It should be noted that investors can only appoint one tax accountant to file tax returns for all of their income.

Tax Implications Chapter 2. Buying/Selling a Property in Japan

—

WealthPark is a real estate technology company that provides online and offline asset management services for overseas investors with properties in major cities of Japan, including Tokyo, Osaka, Yokohama, Nagoya, Kyoto, Fukuoka, and Sapporo. We partner with real estate brokers, real estate developers and technology companies in order to provide investors with comprehensive asset management and property transaction services. We will continue to expand its digital platform to create user experience.

Contact Us: https://wealth-park.com/en/asset-management/#hsforms