2022.12.12

Japan’s Border Easing and Currency Depreciation Boost Tourism Recovery

Due to the impact of the pandemic, the number of tourists entering Japan and their related consumption have decreased dramatically. In 2019, about 31.9 million tourists entered Japan, with consumption reaching JPY 4.8 trillion. However, in 2021, only about 240,000 tourists entered Japan, and consumption decreased to only JPY 120.8 billion.

As countries open their borders, Japan has also accelerated the relaxation of border controls, and as of October 11, 2022, it will cancel the daily limit on the number of people entering the country, exempt the requirement for a short-term entry visa, and permit self-guided travel.

In addition, the yen has depreciated significantly in the same year and it is projected that the number of tourists entering the country and consumption will rebound to pre-pandemic levels. Prime Minister Mr. Kishida also publicly announced that the annual consumption target for tourists entering the country will be set at more than JPY 500 billion. Next, let’s take a look at the number of tourists entering Japan and the hotel operating situation after the relaxation of border controls.

TOC

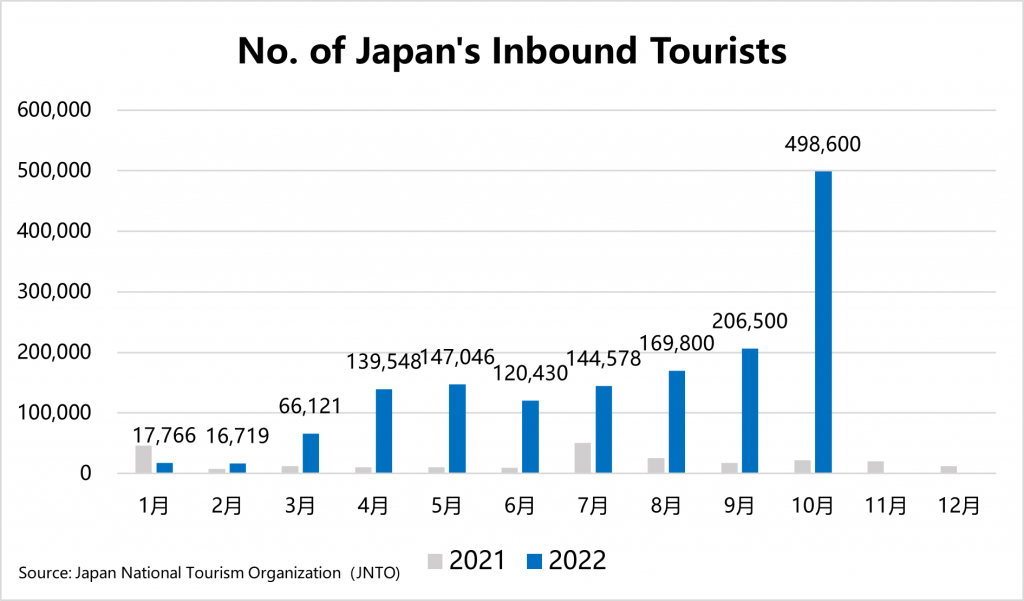

The number of tourists entering the country increased by 22x YoY and 2.4x MoM in October 2022

Since Japan’s borders gradually opened in April 2022, the number of inbound tourists surged up tenfolds from April to September and even extended to 22 times in October. Looking at the regional distribution of arrivals in October, Korea had the biggest proportion (24.6%), followed by the United States (10.7%), Hong Kong (7.3%), Taiwan (7.0%), and Thailand (6.8%), with China accounting for only 4.3%.

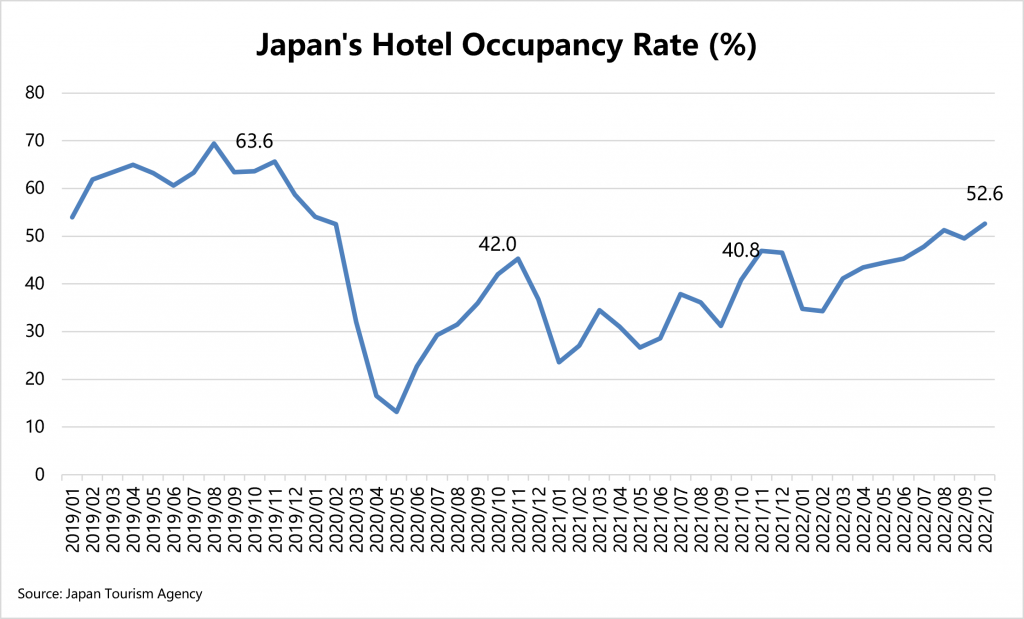

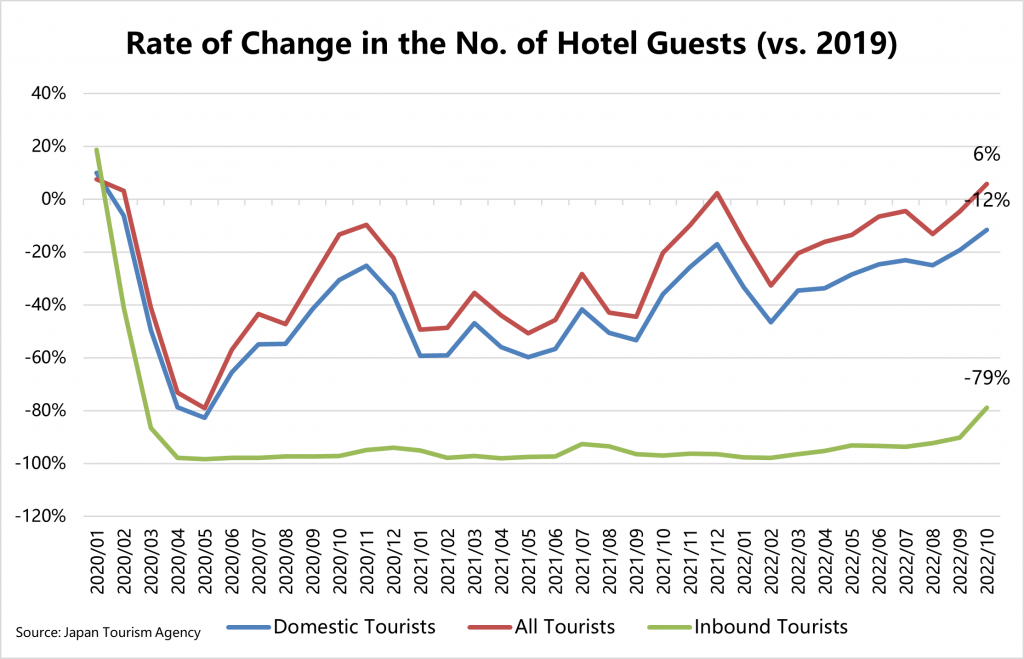

The increase in domestic tourists drove the hotel occupancy rate to 52.6% in October 2022

Japan’s overall hotel occupancy rate increased to 52.6% in October 2022, an 11.8% m-o-m gain and a 3.1% y-o-y increase. Although impressive, it is still a 10% discrepancy from 2019. However, ryokan (traditional japanese hotel) occupancy rate was 39.2%, virtually back to 2019 levels.

In the previous two years, the government has aggressively promoted domestic tourism, giving travel discounts and coupons again in October, effectively increasing domestic tourist expenditure, resulting in a 5.8% rise in total domestic visitors staying in October compared to 2019.

Although the number of Chinese tourists is unlikely to return to 2019 levels in the near future, the depreciation of the Japanese yen is expected to attract a large number of inbound tourists and increase the number of visits to Japan, which, combined with the government’s intention to implement measures to stimulate inbound tourist spending in the future, is expected to significantly increase hotel occupancy rates in Japan, particularly for ryokan and resort hotels.

—

WealthPark RealEstate Technologies is a real estate technology company that provides online and offline asset management services for overseas investors with properties in major cities of Japan, including Tokyo, Osaka, Yokohama, Nagoya, Kyoto, Fukuoka, and Sapporo.

WealthPark partners with real estate brokers and technology companies in order to provide investors with comprehensive asset management and property transaction services. WealthPark RealEstate Technologies will continue to expand its digital platform to create user experience.

Contact Us: https://wealth-park.com/en/asset-management/#hsforms