2020.08.14

WealthPark CIO Suzuki’s Column – Fundamentals of Private Equity Investments and Funds

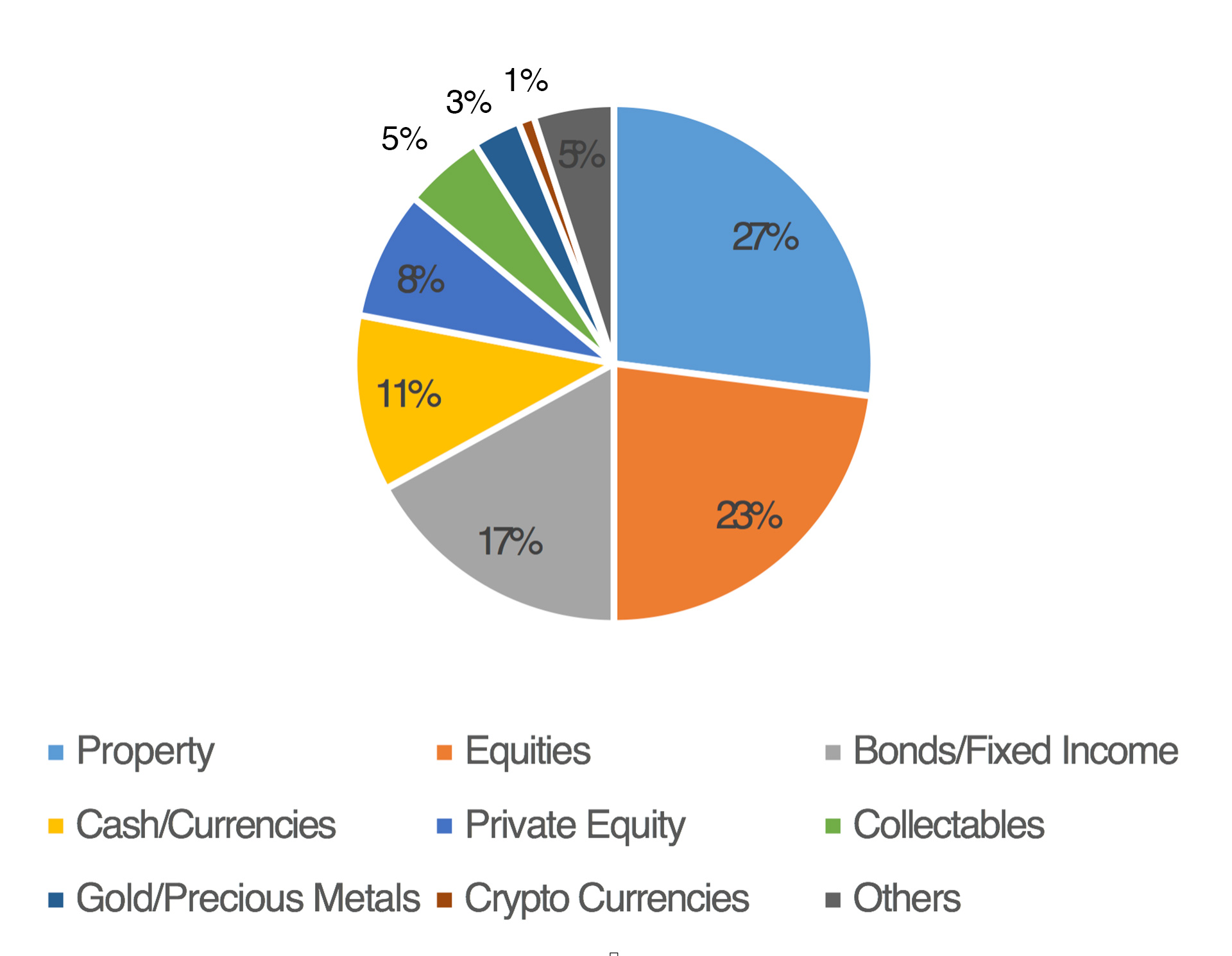

Previously in the June column, I gave an overview of UHNWI and their asset composition based on the Wealth Report 2020 by Knight Frank, the global real estate consultant headquartered in the UK (see Figure 1). We didn’t mention Private Equity at the time, but after Property, Equities, Bonds/Fixed Income and Cash/Currencies, Private Equity accounted for 8% of total assets.

Figure 1 – Asset Composition of UHNWI*s

Source: Knight Frank *Individuals with net worth over JPY 3 billion.

In this article, I would like to introduce the management of assets in Private Equity (unlisted shares), including unlisted equity investment funds, as a basis for private equity.

In contrast to Public Equity, which are shares listed on the stock market, the shares of companies that are not yet publicly traded are called unlisted or private equity.

If you consider investing in an unlisted company in this case, it is easy to invest and acquire shares in a private company, but the timing of your return is limited to when the company (1) goes public, (2) is acquired by the company, or (3) the company itself repurchases its shares.

If the stock is listed or public, you can generally sell your position at any time, but if it is unlisted, there is a risk that you won’t be able to sell the stake for a long time because it is not clear when (1) to (3) will happen. On the other hand, there is a trade-off in that if the unlisted company goes public, you may be able to get a high return. However, there are overwhelmingly more unlisted companies in the world than listed companies, so it might be much more difficult to decide which unlisted company you should allocate your precious money compared to pick up from listed companies. There is an option to invest in a fund with a trustworthy fund manager which then invests the proceeds to multiple private companies. This kind of investments are called: private equity funds.

Thus, in both Japan and the rest of the world, the major investors in unlisted equity investment funds are not only high net worth individuals, but also institutional investors such as government and private banks, securities companies, life and non-life insurance companies, and pension funds.

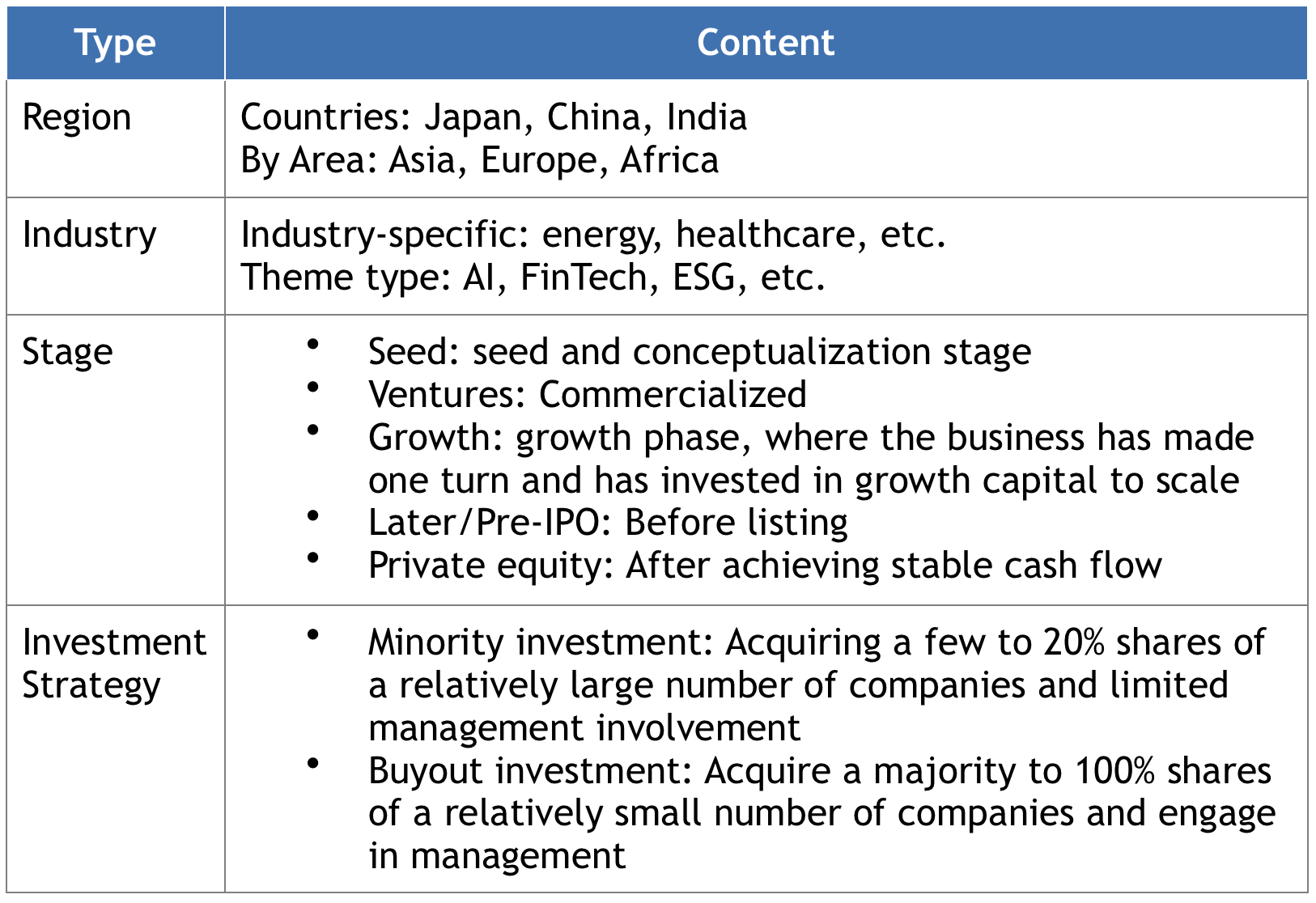

Investing in funds that invest in multiple private companies has a different set of consideration when setting up the fund. From different industries (automotive, logistics, pharmaceuticals, etc.) to stage (new startups to stable companies), and the fund manager. Depending on the operator’s specialty, there are various fund types (see Table 1) that acquires 20% of shares in private companies and those who completely buyouts 100% of the share as well as management of the company.

Table 1 – Fund Types

In general, fund management companies (often called General Partners or GP) start setting up the fund concept with the aforementioned Fund Types to differentiate from other funds.

Let’s assume that you want to set up a private equity fund leveraging your team’s healthcare and financial industry expertise in Asia. At the time, the fund concept should be Asia/Healthcare focused fund but you should also decide whether you focus on minority or majority/buyout investments.

After deciding fund concept, you have to decide on the target size of the fund, the fund period, and the target yield and preferred yield to Investors for the fund to raise, and then approach investors to obtain their investment commitments (commitments) over one year.

The size of the fund does not have to be large but has to be appropriate depending on the number of investment opportunities in regions, industries, stages, etc. that match the fund concept. For example, when I was stationed in India, a fund of 100 billion yen in the unlisted stock investment fund market seemed to have too much money against the investment opportunity.

Additionally, the fund period is generally 10 years, the first half 5 years is concentrated on investment as the investment period, and the second 5 years is the recovery period and it is common to sell the stock and return the profit to the investor. In some cases, the fund period may be as short as 7 years instead of 10 years.

In reality, if the market environment is not good even if the fund period is 10 years, it is better to shift the timing of the sale a little later, which will be a good return for both the fund manager and the investor. It is not uncommon for a party to extend the fund period.

Investors who have promised to invest in the fund do not pay in full immediately, but instead, contribute their investment commitment as a percentage of the total amount of the fund when the fund manager makes the investment commitment and invests in the unlisted company in which the fund will invest. This is called the capital call.

Then, after the fund invests and returns the principal amount and the preferred yield that was initially communicated to investors when the fund sells and makes a profit, the fund manager receives a portion as a carried interest/success fee and the remainder is generally received by the investors.

The author was an investor in a venture growth or later stage fund specializing in energy, internet, and telecommunications in Japan and a fund manager in Mumbai for four and a half years, investing in Indian growth stage companies in India. After that, the author was involved in buyout investment in Japan and seconded to the portfolio company as an resident director of the company.

In India, at the time of my residency, majority buyout investments were not common, and many funds with buyout investment concepts were making actually minority stake investments. Under such situations, even though it was a growth-stage investment fund, it was deeply involved in the management of investee companies(portfolio companies), unlike the growth stage in developed countries including Japan. As such, even if you describe the fund “growth minority-focused fund”, it should be highlighted that actual activity is slightly different depending on areas.

This time, I explained the basic structure of unlisted stock investment and unlisted stock investment funds as an asset choice. This asset class, which is currently limited to the wealthy and institutional investors, may gradually open up to individuals.

Although there may be various issues, including liquidity, we believe that investors who understand and recognize the risks may find investment opportunities in these unlisted stocks and unlisted stock investment funds interesting.

[Disclaimer]

This article contains the author’s personal opinions, and if you have any questions or concerns about this article, please contact the author for further information.

This article is not intended as a solicitation or recommendation to buy or sell any kind of investment, nor is it a suggestion or guarantee of any investment results or investment returns. The Company shall not be liable for any loss or damage caused based on this article.