2020.07.17

Suzuki’s Column – From the desk of WealthPark’s CIO Inspirations from US Residential and Commercial Real Estates

In this issue, I will share my thoughts on the Japanese residential and commercial office real-estate market drawing observations from the United States.

The U.S. public have been plagued by effects of Covid-19 which marked a significant change to living behavior. Until now, the majority of Americans only have 1 primary residence and reserves their secondary properties for investment purposes. However, a new trend emerged where the secondary property is also used by the owner as a second residence or villa.

This was evident in New York, a Covid-19 epicenter, where demands for Connecticut properties, a suburban paradise, experienced an explosive growth. It is extremely difficult to uproot their residence from New York due to the proximity to their office, nearby infrastructures (schools, medical facilities, senior care, etc.) but the pandemic transformed the area into a danger zone. This results in either a need for ① remote work or ② moving work locations.

These two options are driven by corporate policies but will have significant impact on personal decisions.

From this perspective, corporates are making decision for relocating offices based on reducing costs but it might also be due to the rise of flexible office space and the ease of remote work.

Breather Products Inc. is an American company focused on providing flexible office space where companies can make reservations on a platform as simple as Uber. Breather’s CEO: Bryan Murphy mentioned that when a company wants to cancel an existing lease, it is usually complicated and beneficial for the owner. Therefore, Breather provides a strong alternative when companies are making leasing decisions.

Recently, New York real estate developer Michael Schvo acquired Transamerica Buildings, a property in San Francisco, at a 10% discount (projected valuation was JPY 70 billion) (July 8th, 2020). Due to this fluctuation in property prices, companies have also considered moving offices but due to the pandemic and uncertainties had decided to choose more flexible office solutions or remote workspace.

With companies having more options in choosing where they work, office providers are incentivized to use technology to offer a full suite of solutions to improve tenant satisfaction and increase rent. From improving safety measures to having productivity features, office providers are scrambling to differentiate themselves.

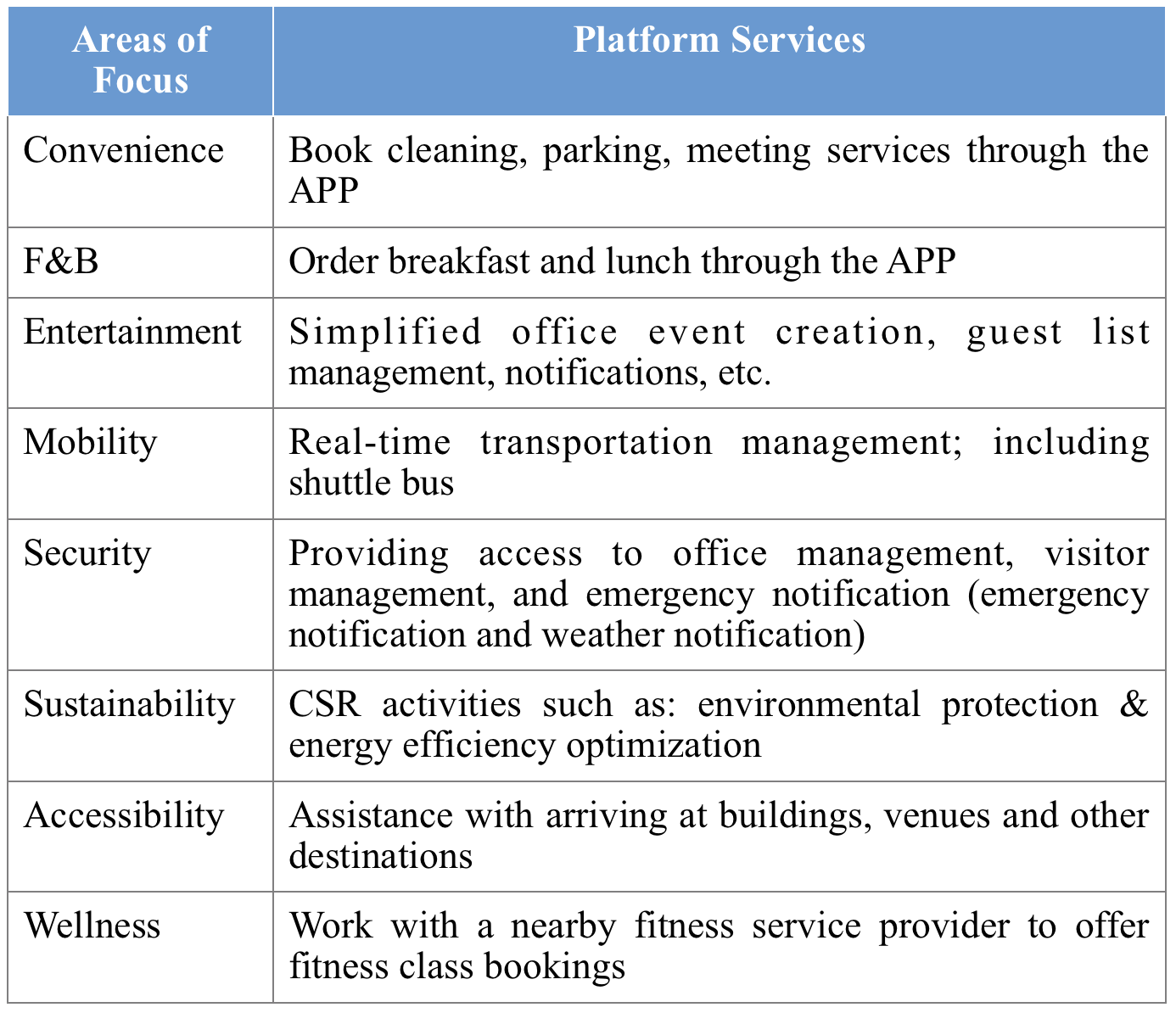

Under this scenario, there are also companies that are doing what HqO in the U.S. does, which is aggregating many real estate technology companies into one platform for supplying office providers (see Table 1).

Table 1:

Due to the impact of the coronavirus, there has been a focus on improving portfolio optimization and analytics on space usage. A service that solves this issue is VergeSense, introduced in a past article, but the overall trend is to improve tenant satisfaction and I believe that the technology or solution chosen must be tailored to the prevailing circumstance.

Although data provided by technology companies and related companies allow for optimizations, there are still many hurdles which must be overcame due to security and other factors. Japan is different from countries with multiple options such as the United States (where they can choose: Las Vegas, New York, and San Francisco) due to the limited locations to choose from. Therefore, I think and hope the development of “flexible office space + technology” will be adopted even faster.

Reference:

- Michael Schvo’s Transamerica Buildings 10 discount purchase (BISNOW)

- HqO’s 8 areas of focus for technology providers