2020.07.31

WealthPark CIO Suzuki’s Column – Market Overview of New Properties

In the past I introduced various market trends pertaining to secondhand properties but in this issue, we will dive into the new properties segment based on data released by the Institute of Real Estate Economics on July 15. We will investigate the number of new properties listed vs number of properties sold, changes in selling prices, and various price bands in 5 distinct regions (central Tokyo, Tokyo suburbs, Kanagawa Prefecture, Osaka City, Osaka Prefecture).

TOC

1. Central Tokyo

a. New Properties Sales

In the past year, the average number of new property listings in the heart of Tokyo was approximately 1000 a month. Under the influence of the Covid-19, the sales volume in April and May of 2020 dropped to 500 but in June it rebounded to 730 (only an 18% decrease compared with the same month last year). The ratio between properties sold to listings available in the month exceeded 60% (see Figure 1-1).

Figure 1-1 Central Tokyo New Properties Supply and Demand

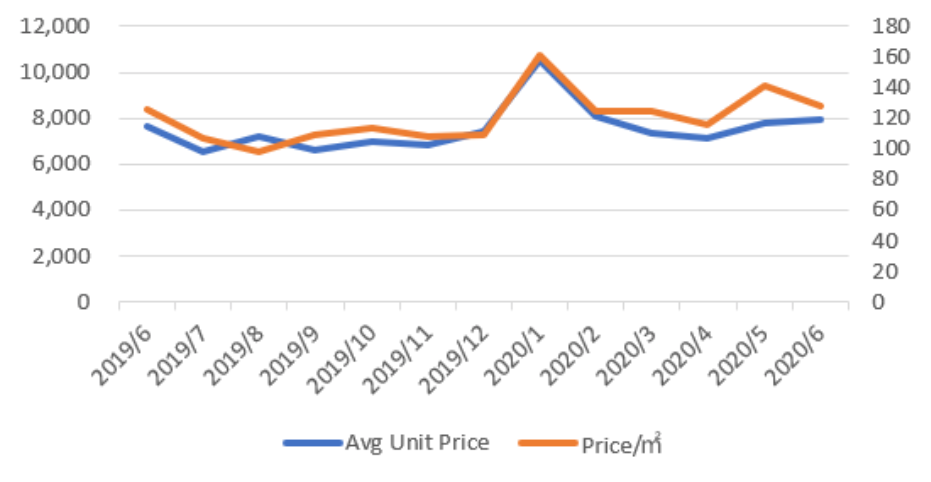

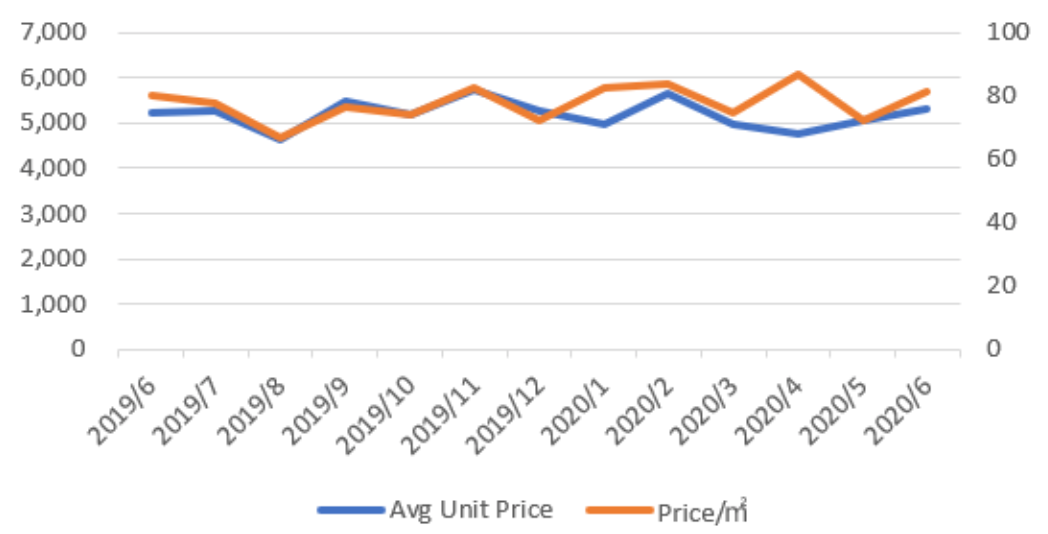

b. New Properties Price

The average price of a new property in the central Tokyo was around 75 million yen last year and was 79.62 million yen in June 2020, a 4% increase from the same period last year. In June 2020, it was be 1.28 million yen, an increase of 2% compared to the same period last year. (Figure 1-2)

Figure 1-2 Central Tokyo Average Unit Price and Price per Squared Meter

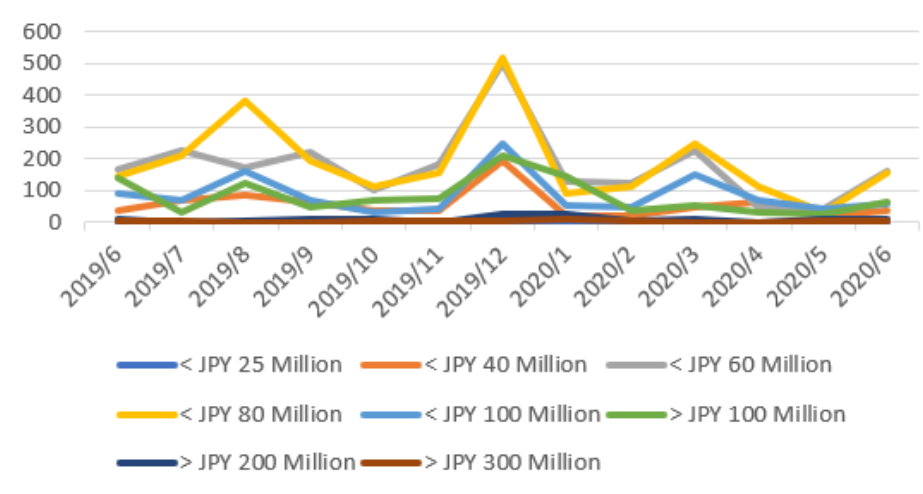

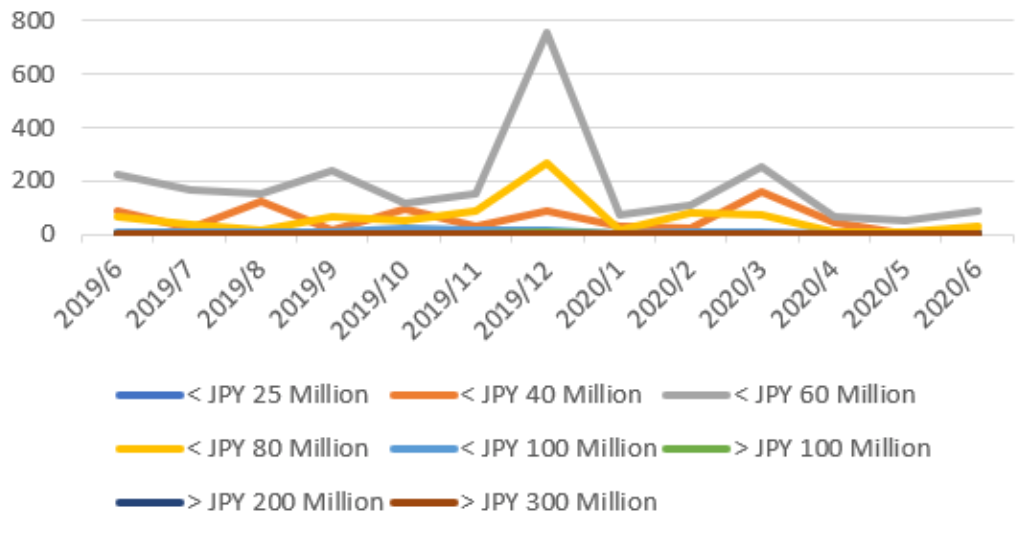

c. Price Bands

Looking at price bands in Central Tokyo, most properties were between JPY 40 million to 80 million. Additionally, there has been a 20% growth in properties sold for new homes listed between JPY 100 million to 200 million in June compared with last year. (Figure 1-3)

Figure 1-3 Central Tokyo Price Bands

2. Tokyo Suburbs

a. New Properties Sales

The sales volume of new properties in the suburbs of Tokyo averaged 170 units per month last year. Under the influence of the Covid-19, it fell to 50 in April and May 2020 but returned to 134 in June (which was only 2% less than the same period last year). The ratio between properties sold to listings available in the month also exceeded 60%. (Figure 2-1)

Figure 2-1 Tokyo Suburbs New Properties Supply and Demand

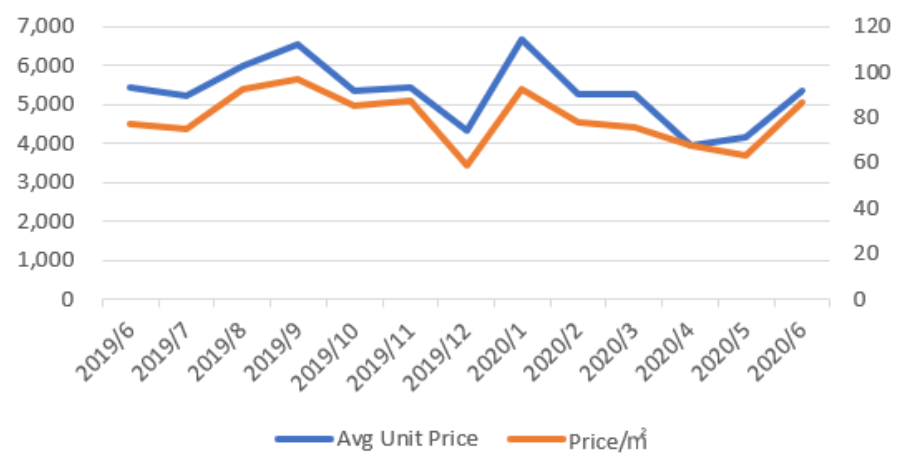

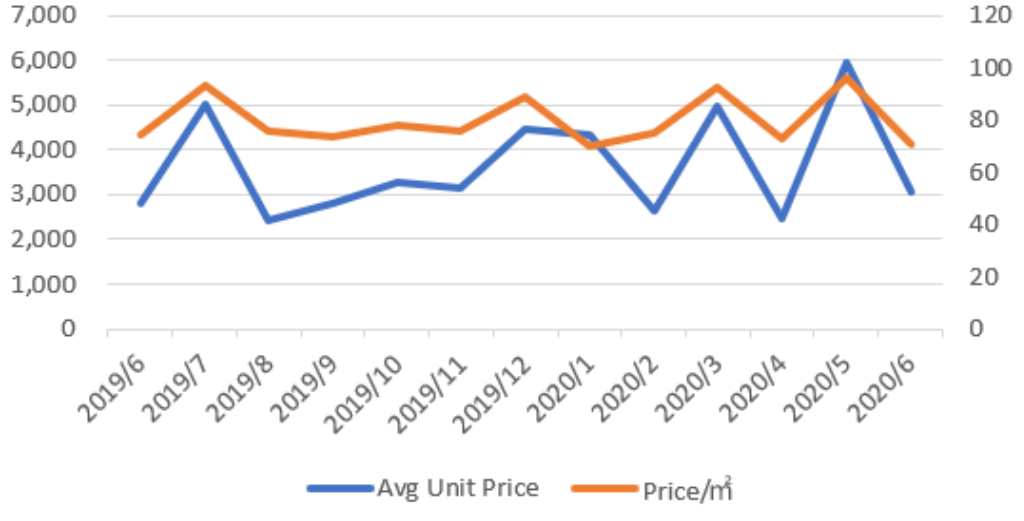

b. New Properties Price

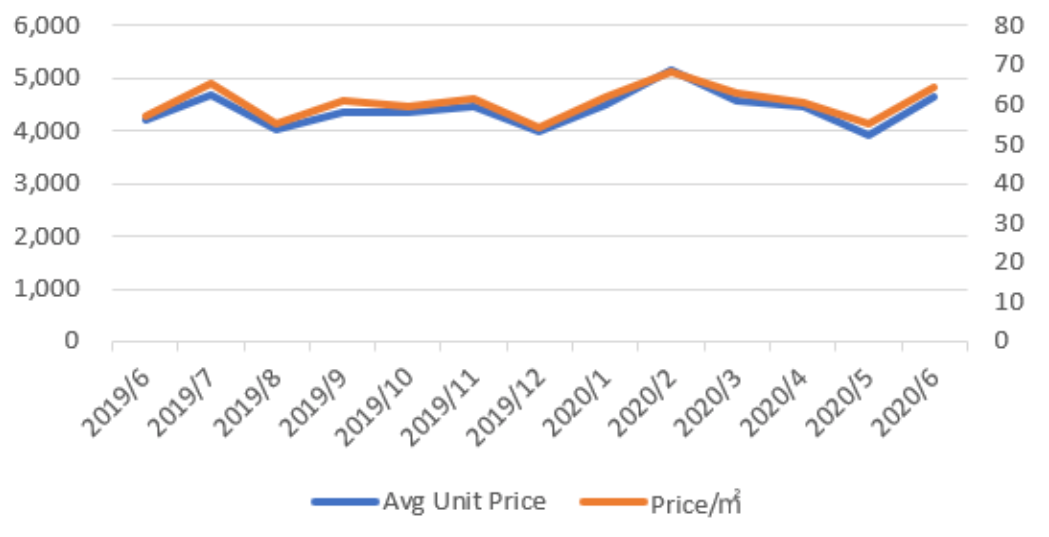

The average price of a new home in the suburbs of Tokyo was around 53 million yen in the past year and 53.3 million yen in June 2020 (a decrease of 1% compared to the same period last year). In June 2020, it was 870,000 yen, an increase of 13% compared with the same period last year. (Figure 2-2)

Figure 2-2 Tokyo Suburbs Average Unit Price and Price per Squared Meter

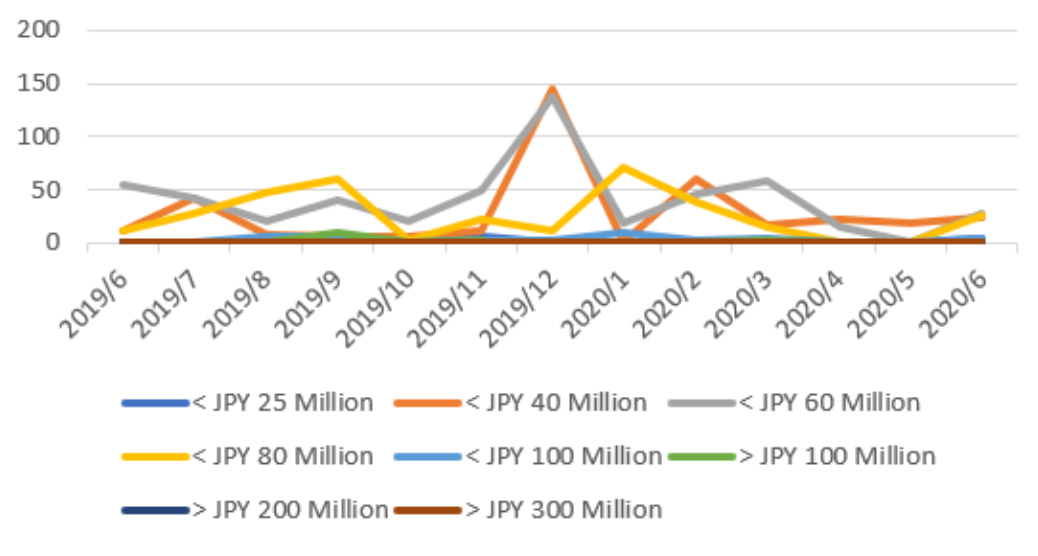

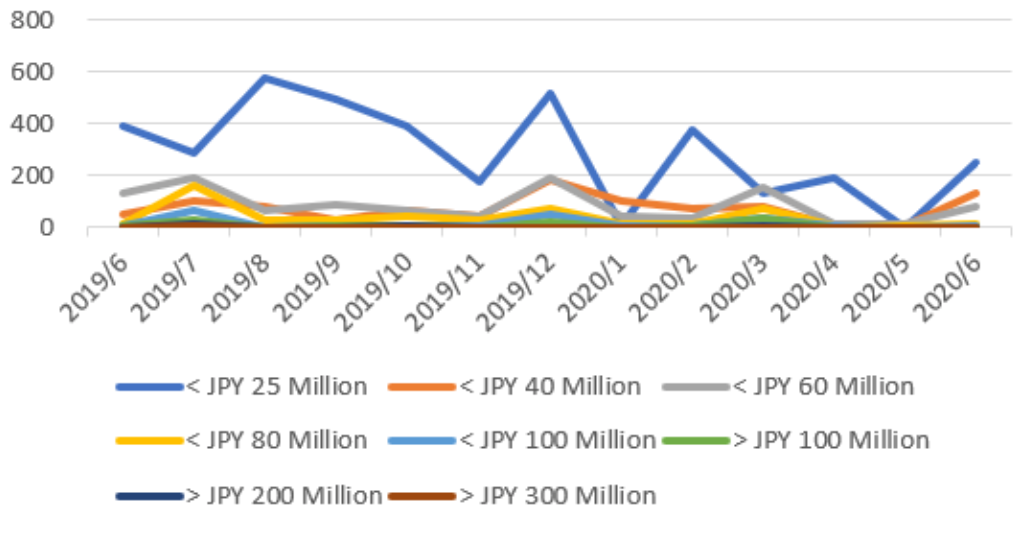

c. Price Bands

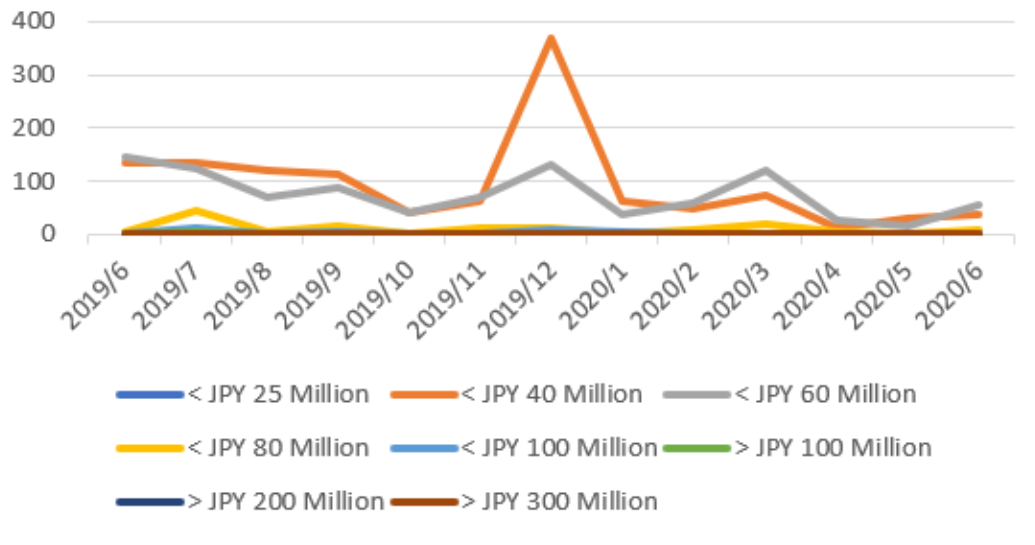

The sales price of new properties in the suburbs of Tokyo is between 25 million and 60 million yen, but the sales price for more than 60 million yen and less than 100 million yen has increased in June 2020 compared to the same period last year. (Figure 2-3)

Figure 2-3 Tokyo Suburbs Price Bands

3. Kanagawa Prefecture

a. New Properties Sales

In the past year, Kanagawa Prefecture has been offering an average of 460 new listings per month, and with the Covid-19 looming, the number fell to 150 in April and May 2020. 180 homes were sold in June, down 71% from a high of 617 in the same period last year. The ratio between properties sold to listings available in the month also exceeded 70%. (Figure 3-1)

Figure 3-1 Kanagawa Prefecture New Properties Supply and Demand

b. New Properties Price

The average price of a new properties in Kanagawa Prefecture was around 52 million yen last year and was 53.12 million yen in June 2020 (an increase of 2% compared to the same period last year). The average price of a square meter unit was 800,000 yen last year and 820,000 yen in June 2020, a 2% increase from the same period last year. (Figure 3-2)

Figure 3-2 Kanagawa Prefecture Average Unit Price and Price per Squared Meter

c.Price Bands

The contracted price of new houses in Kanagawa Prefecture is between 40 million and 60 million yen and it is approximately the same as last year in June 2020. (Figure 3-3)

Figure 3-3 Kanagawa Prefecture Price Bands

4. Osaka City

a. New Properties Sales

In the past year, about 660 new homes were put up for sale every month in Osaka City. The number of new properties sales dropped due to the Covid-19 to 250 in April and May 2020, but 610 in June (which is only 19% less than last year). The ratio between properties sold to listings available in the month was over 70%. (Figure 4-1)

Figure 4-1 Osaka City New Properties Supply and Demand

b. New Properties Price

The average price of a new home in Osaka City has averaged around 36 million yen over the past year and will average 30.47 million yen in June 2020 (9% increase from the same month last year). In June 2020, it was 30.47 million yen, which is 9% higher than the same month last year. The average price of a square meter unit in the past year was 800,000 yen, the same level as the suburbs of Tokyo and Kanagawa Prefecture, but it was 700,000 yen in June 2020, which is 5% lower than the same month last year. (Figure 4-2)

Figure 4-2 Osaka City Average Unit Price and Price per Squared Meter

According to data from the Institute of Real Estate Economics, the Kinki region, unlike the heart of Tokyo, the suburbs of Tokyo, and Kanagawa prefecture, has large monthly changes in average prices and unit prices per square meter because of the small size of the market, the strong influence of one whole building, and the fact that the data also includes investment apartments (relatively small suites). Basically, the average price in the month in which investment condominiums are offered for sale also decreases, and the same is likely to happen in June 2020.

c. Price Bands

In Osaka, the purchase price of new properties is overwhelmingly below 25 million yen, followed by the property band of above 25 million yen and below 60 million yen. The number of properties between 25 million yen and 40 million yen has increased significantly between June 2020 and the same period last year. (Figure 4-3)

Figure 4-3 Osaka City Price Bands

5. Osaka Prefecture

a. New Properties Sales

In the past year, the Osaka prefecture launched an average of about 270 new units per month, but the number of units fell to 100 in April and May 2020 due to the impact of Covid-19. The number of 188 units in June 2020 decreased by 55% compared to 420 units in the same period of the previous year. The ratio between properties sold to listings available in the month fell to 60%. (Figure 5-1)

Figure 5-1 Osaka Prefecture New Properties Supply and Demand

b. New Properties Price

The average price of a new home in Osaka Prefecture was around 44 million yen in the past year and was 46.36 million yen in June 2020 (an increase of 10% compared to the same period last year). In June 2020, it was 46.36 million yen, an increase of 10% compared to the same period last year. The average price of a square meter unit was 600,000 yen in the past year, but it was 640,000 yen in June 2020, an increase of 13% compared to the same period last year. (Figure 5-2)

Figure 5-2 Osaka Prefecture Average Unit Price and Price per Squared Meter

c. Price Bands

Osaka Prefecture’s new home prices range from 25 million yen to 40 million yen, and look to be stable in June 2020 compared to the same period last year. (Figure 5-3)

Figure 5-3 Osaka Prefecture Price Bands

Generally speaking, due to the Covid-19 state of emergency declaration, the numbers of new properties listed and sold in April and May of 2020 dropped significantly but it recovered in June. It is also clear that the price has not fallen sharply.

In this issue, we investigated the number of new properties listed vs number of properties sold, changes in selling prices, and various price bands based on public data.

In the future, I would also like to share more in-depth comparisons with second hand properties.

【Disclaimer】

This article contains the author’s personal opinions. So, if you have any questions or concerns, please feel free to contact us. Any questions will be greatly appreciated.

This article does not intend to solicit or recommend buying or selling any investment, nor does it imply or guarantee any investment results or returns. No responsibility is assumed for any loss caused by this article.