2020.05.29

COVID-19 IMPACT: What 2nd Hand Housing Data Reveals

By examining the listing data provided by the Center for the Promotion of Real Estate Circulation on May 15th, we got a candid look into the effects of the coronavirus pandemic on the second-hand housing market.

TOC

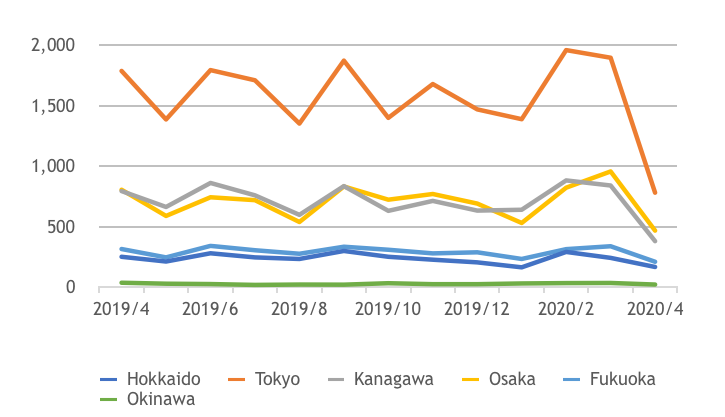

1. Number of Transactions in the Second-Hand Market

There has been significant decrease in sales in each region year-over-year for April 2020 where we saw a 56% decrease in Hokkaido, 52% decrease in the Kanagawa Prefecture, 42% decrease in Osaka, 33% decrease in Fukuoka, and 38% decrease in Okinawa.

Figure 1: Number of Second-Hand Housing Transactions

This is a further decrease from the y-o-y data we shared last month (12% decrease in Hokkaido, 9% decrease in Tokyo, 16% decrease in Kanagawa, 3% increase in Osaka, 18% decrease in Fukuoka, and 14% decrese in Okinawa).

The contraction in sales data we witnessed is mainly driven by news surrounding the coronavirus. Of note: Japan declared a state of emergency on April 7th , followed by Hokkaido prefecture solely declaring its state of emergency on 28th Feb.

As of the 25th of May, 2020, Japan has completely lifted its nationwide state of emergency. Therefore, the downward trend is anticipated to continue for May. As the nation deals with its loosened coronavirus restrictions and prepares to restart the economy, there is a high possibility the trend will extend to June.

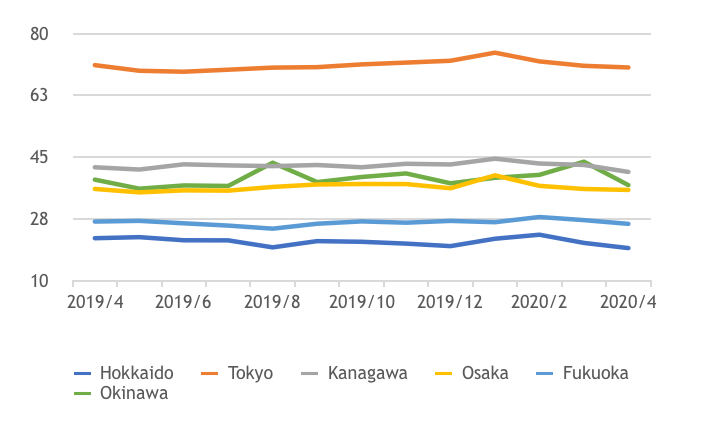

2. Transaction Price of Second-Hand Market

To discern the transaction price fluctuation, we compared the y-o-y data for April 2020. Hokkaido was observed to have fallen by 13%, Tokyo down 1%, Kanagawa down 3%, Osaka down 1%, Fukuoka down 2%, and Okinawa down 4% (see Figure 2).

Figure 2: Transaction Price of 2nd Hand Properties (Unit: JPY 10,000)

Japan has remained resilient against price fluctuation from the pandemic as seen from the preceding month’s data (Hokkaido rising 1%, Tokyo falling 1%, Kanagawa falling 2%, Osaka remained steady, Fukuoka falling 3%, and Okinawa increasing 5%). However, from April’s data, we do see a fall in transaction price for Hokkaido and fluctuation in Okinawa.

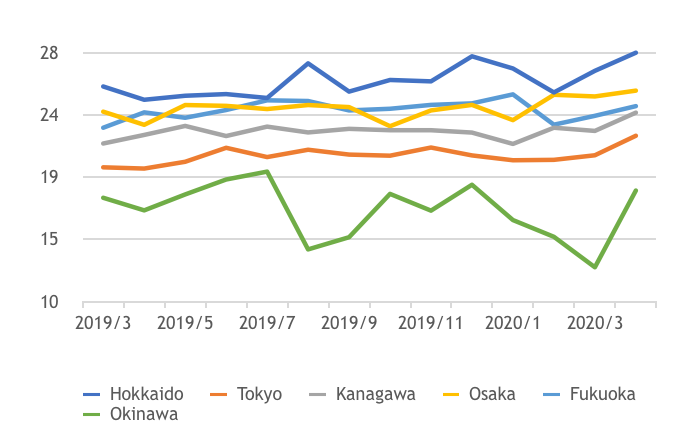

An important factor that explains the transaction price is the age of the properties sold. Hokkaido’s average property age for real estate transactions during 2020 was 28 years old. This is a 14% increase in age compared with properties sold in April 2019. Similarly, a 9% increase in age was observed in Okinawa (April 2019: 16.6 years old vs April 2020: 18 years old).

Figure 3: Average Age of Property Sold

Based on these data provided, it can be concluded that the age of the property plays a more important role in the transaction pricing while the coronavirus had an immediate impact on the number of transactions due to the suspension of economic activities.

As the state of emergency is being lifted, it is imperative to exercise vigilance as the economic activities are restarting. The number of transactions is predicted to remain lower compared to last year and the speed of economic recovery will have a material impact on the decrease of transaction price.

As said in the previous article, it must be inevitable to have adverse impact on numbers of transaction and on transaction price in the short term. However, considering the fact that the population of Okinawa is growing and Tokyo/Kanagawa prefecture have robust fundamental demand, there would be still good reason to become positive on holding or buying in the medium to long term.

I hope the above information can serve as a reference for everyone.