2020.07.27

WealthPark CIO Suzuki’s Column – See How COVID-19 Influences the Pre-Owned Property Market from the Latest Sales Data

Mr. Suzuki, CIO of WealthPark, has been observing Japanese real estate related information for a long time. Today, Mr. Suzuki would like to walk you through the property sales data for pre-owned property released by The Real Estate Transaction Promotion Center on July 10, to together observe how COVID-19 has been affecting the market.

TOC

1. Number of Pre-owned Property Transaction

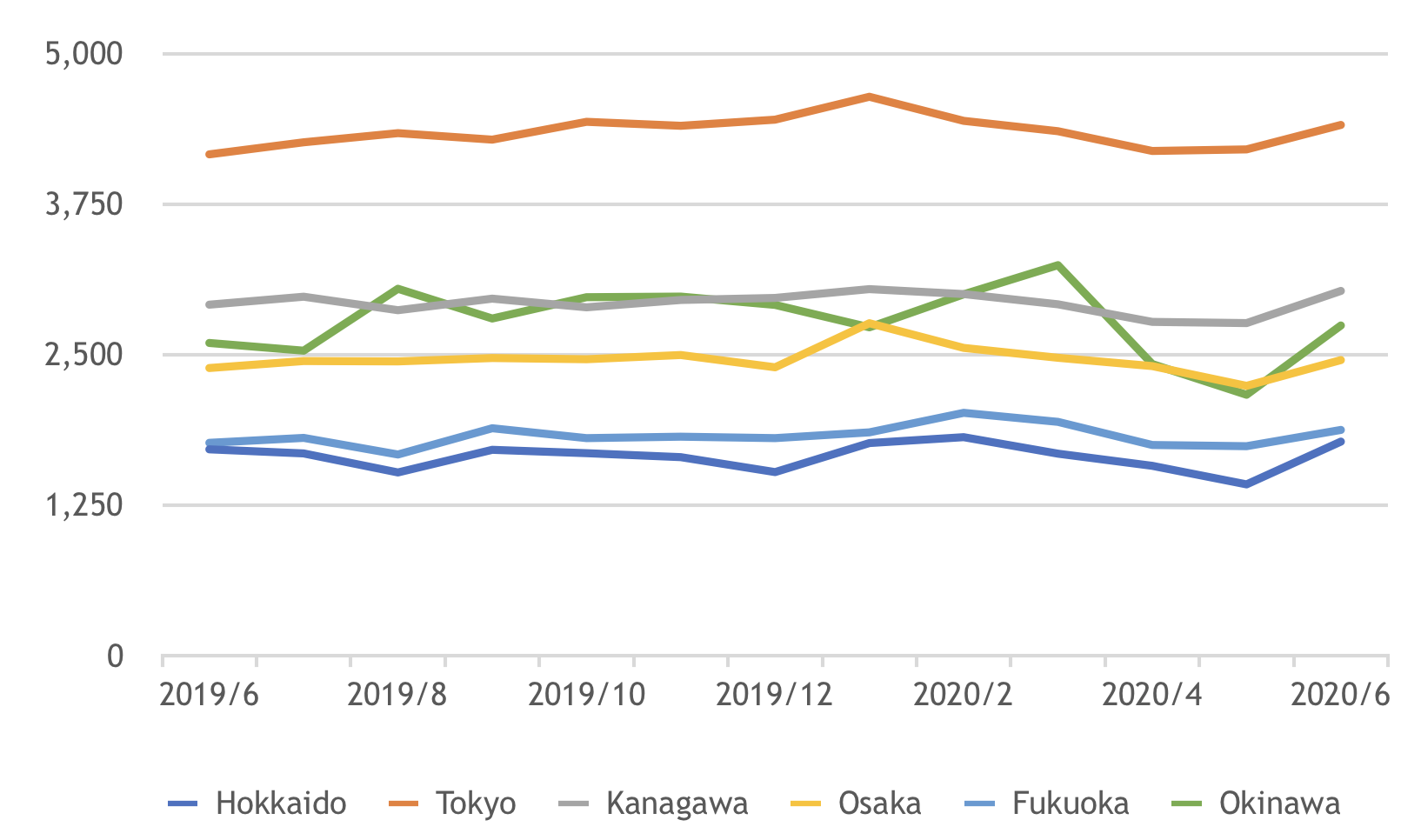

Compared to June 2019, the number of sales in June 2020 decreased by 34% in Hokkaido, 12% in Tokyo, 16% in Kanagawa, and 22% in Fukuoka. However, the number increased by 6% in Osaka and 21% in Okinawa. (Figure 1)

Figure 1: Number of pre-owned property transaction

Per the article we launched last month, compared to May 2019, the number of sales in May 2020 decreased by 31% in Hokkaido, 38% in Tokyo, 40% in Kanagawa, 35% in Osaka, 26% in Fukuoka, and 19% in Okinawa. Compared to last month, the decrease rates in Hokkaido, Tokyo, Kanagawa and Fukuoka have softened, while those in Osaka and Okinawa have increased.

As a matter of course, the reason for the recovery as a whole compared to last month is that the state of emergency was lifted on May 25, hence the economic activities resumed. Although it is said that economic activity has resumed since the decrease rates in areas such as Hokkaido, Tokyo, Kanagawa, and Fukuoka have softened compared to what they were last month, the decrease rates are still large compared to what they were in the same month last year. The economy is resuming for sure, not all in once but resuming gradually.

Even until now, Japan is still on alert. It is expected that the number of pre-owned property sales announced in July will decrease compared with the number in July 2019.

2. Average price for sold pre-owned properties

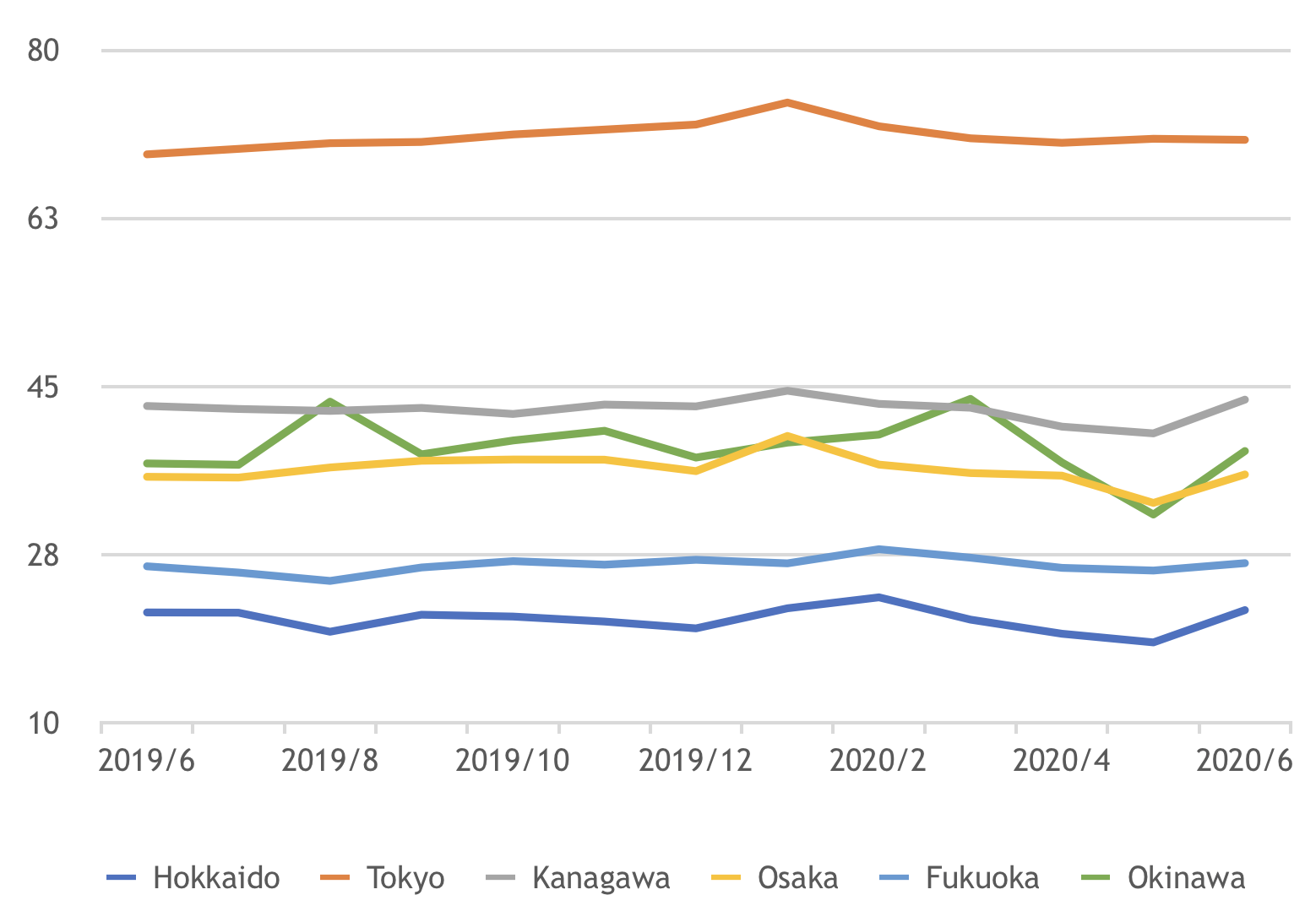

Next, let’s see how Average price for sold pre-owned properties fluctuates. In June 2020, the average price for sold pre-owned properties in Hokkaido was 17.79 million JPY (+4% YoY), in Tokyo was 44.08 million JPY (+6% YoY), in Kanagawa was 30.30 million JPY (+4% YoY), in Osaka was 24.56 million JPY (+3% YoY), in Fukuoka was 18.76 million JPY (+6% YoY), and in Okinawa was 27.43 million JPY (+6% YoY). Even if the average sold price rises, it may be related to the average area traded. Here, we would also like to take a look at the unit price per square meter.

Figure 2: Average price for sold pre-owned properties (Unit: 10,000 JPY)

3. Unit price per ㎡ for sold pre-owned properties

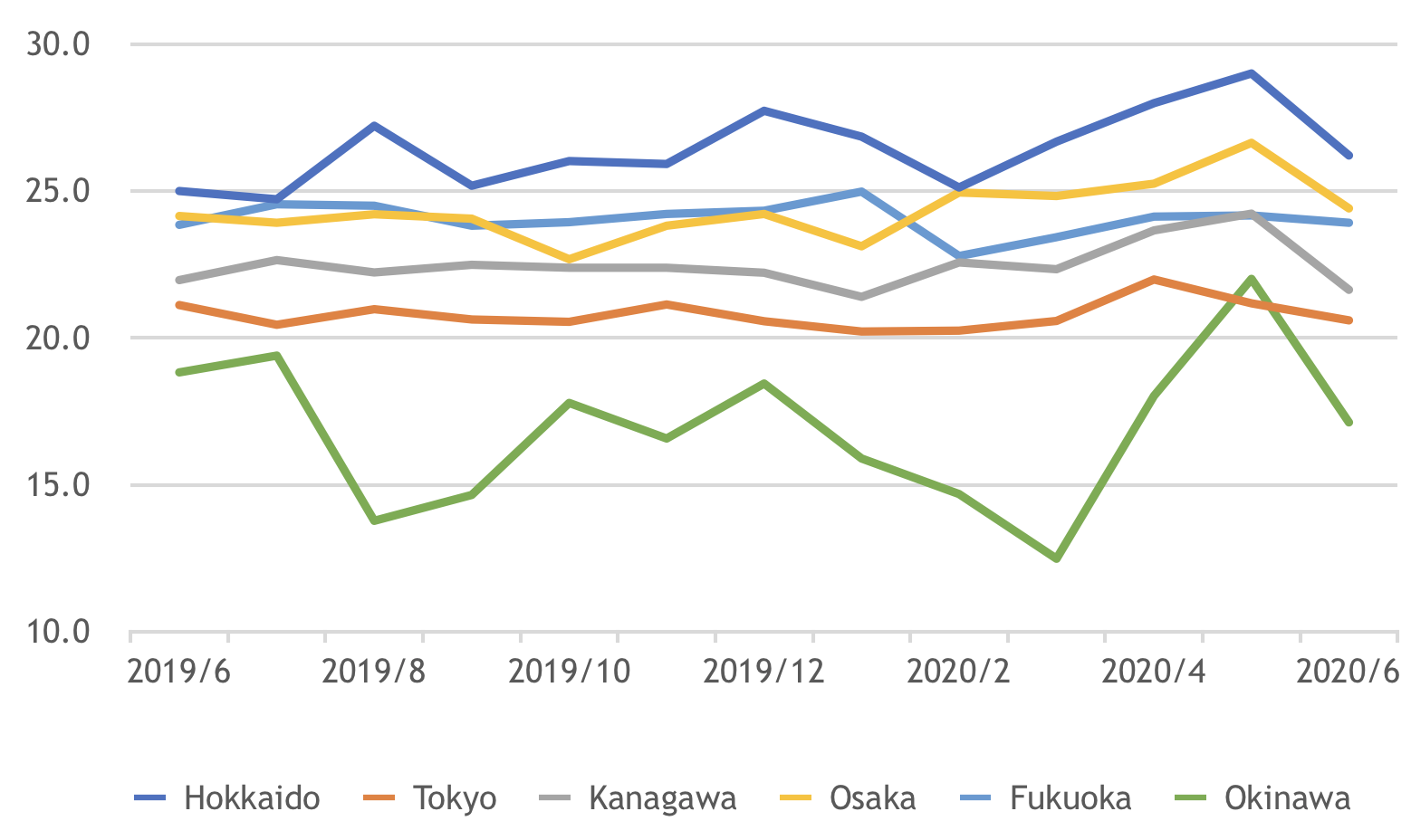

Compared to the unit price per square meter of sold pre-owned properties in June 2019, the unit price in June 2020 increased by 1% in Hokkaido, 2% in Tokyo, 2% in Kanagawa, 1% in Osaka, 1% in Fukuoka, and 3% in Okinawa. (Figure3)

Figure 3: Unit price per square meter of pre-owned property transaction (Unit: 10,000 JPY)

Per mentioned last month, the unit price per square meter in May 2020 compared to the price in May 2019 decreased by by18% in Hokkaido, 3% in Kanagawa, 6% in Osaka, 4% in Fukuoka, 12% in Okinawa and increased by 2% in Tokyo. When we look into the data, we see a major recovery in Hokkaido, Osaka, and Okinawa.

Some people may get confused by the comparison numbers. Those who read the article launched on June 26 should remember, in May 2020 Hokkaido, Osaka, Okinawa, the reason why the unit price per square meter fell compared with the same month of the previous year was because of the traded properties are relatively older. The unit price actually increased under the influence of COVID-19 compared to the unit price in the previous year. Hypothetically this may be because the transaction done in July 2020 was relatively new properties compared to it was in the previous year.

To confirm this point, let’s also take a look at the average age of properties for sale. In Tokyo, the average property age was 20.6 years in June 2020, 2% younger than the average property age 21.1 years in June 2019. Similarly, in Kanagawa, the average property age was 21.6 years in June 2020, 2% younger than the age of 22.0 years in June 2019. In Okinawa, the average property age was 17.1 years in June 2020, 9% younger than the age of 18.8 years in June 2019. This is probably the reason behind the unit price increase. (Figure 4)

Figure 4: Average age of pre-owned property for sale

Considering these points, it can be understood that the impact of the COVID-19 has not reached the point to make the price drop as a whole. Although the State of Emergency has been lifted, economic activity is slowly resuming, and the number of transactions continues to decline YoY, as we understand, the decrease in price appears partially but it doesn’t mean the decrease in price is an overall tendency.

On the other hand, as we analyzed in the article on July 17, 2020, on the assumption of remote work in the United States, people will tend to purchase properties in suburban areas and have a flexible contract in their workplace or office selection. If the remote work / telework in Japan continues, we believe that the demand will increase in regions that are different from pre-COVID and that will possibly create the associated impact in price.

WealthPark will continue to pay close attention to the market and provide you with the latest analysis and insights.