2020.07.03

Investing Lessons from the Ultra-Wealthy – Residential Real Estate Edition

In a previous edition of this article (2 weeks ago), we examined the asset composition of UHNWIs (individuals with a net worth exceeding US$ 30 million) and introduced the profitability of investment into collectibles such as whiskey, liquor, and art.

This time, we will provide an overview into the growth of the global residential real estate prices similarly using the Wealth Report 2020 14th Edition (published by Knight Frank).

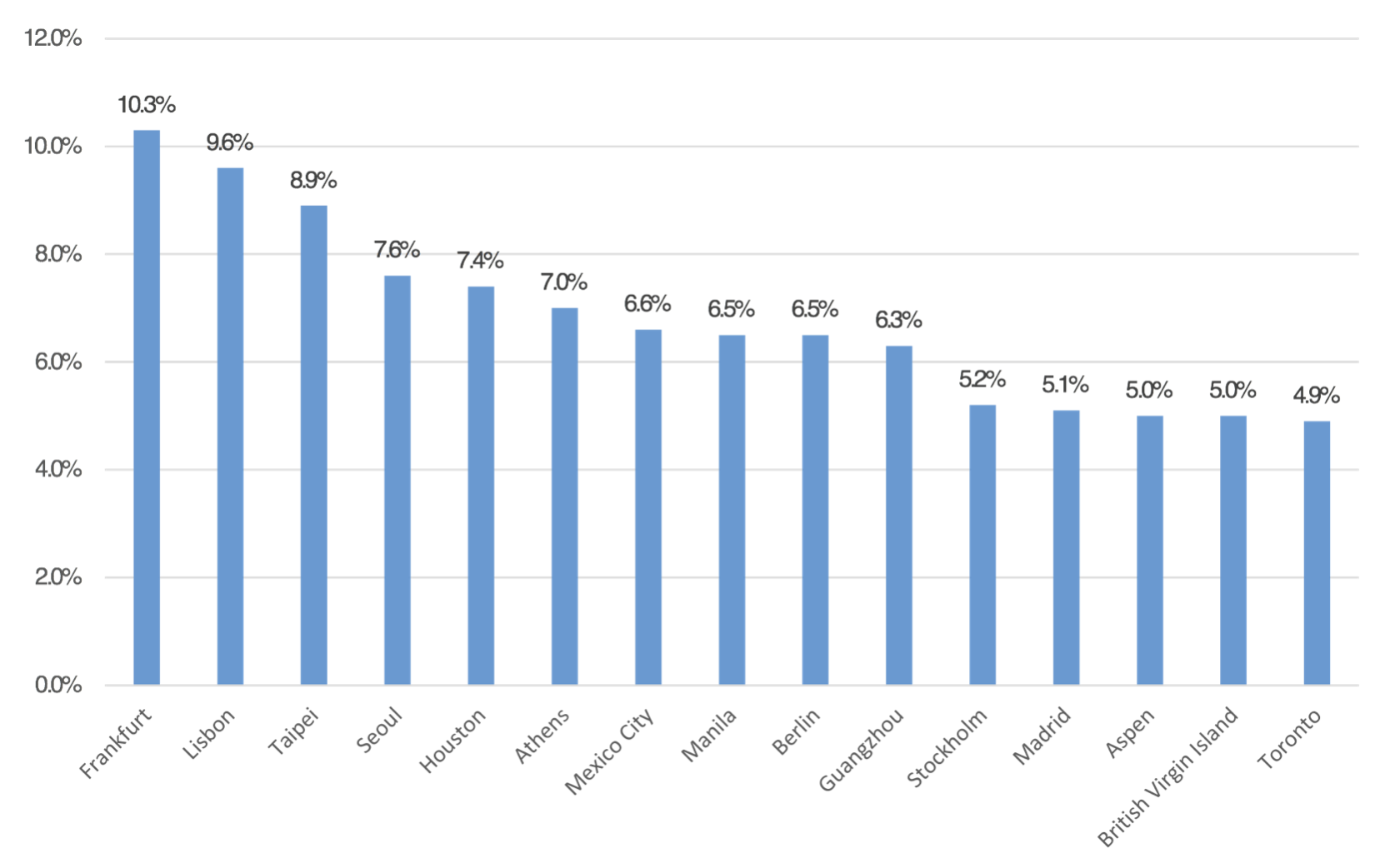

According to data provided by Knight Frank, there was a 1.8% annual growth in global residential prices in 2019. We can examine the top 15 cities with the highest growth in Figure 1.

Figure 1 – 2019 Residential Real Estate Price Growth (Top 15 Cities)

Source: The Wealth Report (2020 – 14th edition), Knight Frank

In Europe, despite economic uncertainties, prices grew in Frankfurt (+ 10.3%), Lisbon (+ 9.6%), Athens (+ 7.0%), and Berlin (+ 6.5%).

Frankfurt, which saw the highest growth in the world is a major financial hub home to the European Central Bank and is the heart of Germany’s financial center. Previously, the metropolis favored commercial real estate but since 2013, the population exploded injecting an extra 11,000 residents annually causing a shift towards residential real estate.

In Asia, China’s growth was stunted in response to the US-China trade war while Taipei (8.9%) and Seoul (7.6%) maintained high growth rates. Although Tokyo did not make the top 15, it still blossomed by 3.2%.

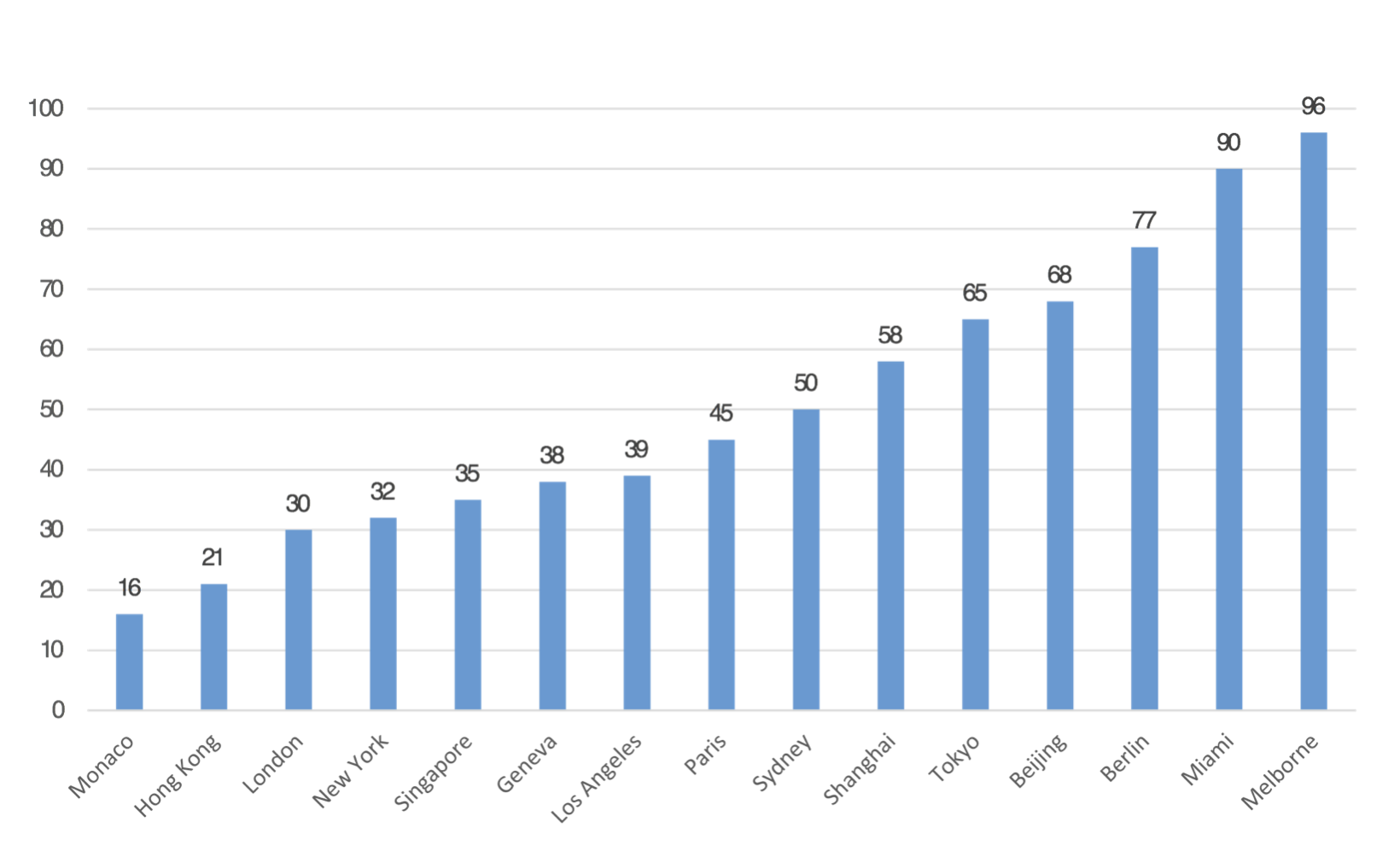

When looking at residential property prices between cities, which city is relatively more expensive?

To uncover this, we referred to Knight Frank’s “How Many Square Metres of Prime Property US$1M (approximately JPY 100 million) Buys in Selected Cities” as shown in Figure 2.

Figure 2 – Square Metres Purchase with US$ 1 M (Top 15 Cities)

Source: The Wealth Report (2020 – 14th edition), Knight Frank

Prices tend to be higher in developed countries and the rate of price growth is often low. However Berlin (+6.5%), Paris (+4.3%), Sydney (+3.7%), Geneva (+3.5%), and Tokyo (+3.0%) all maintained high growth rates.

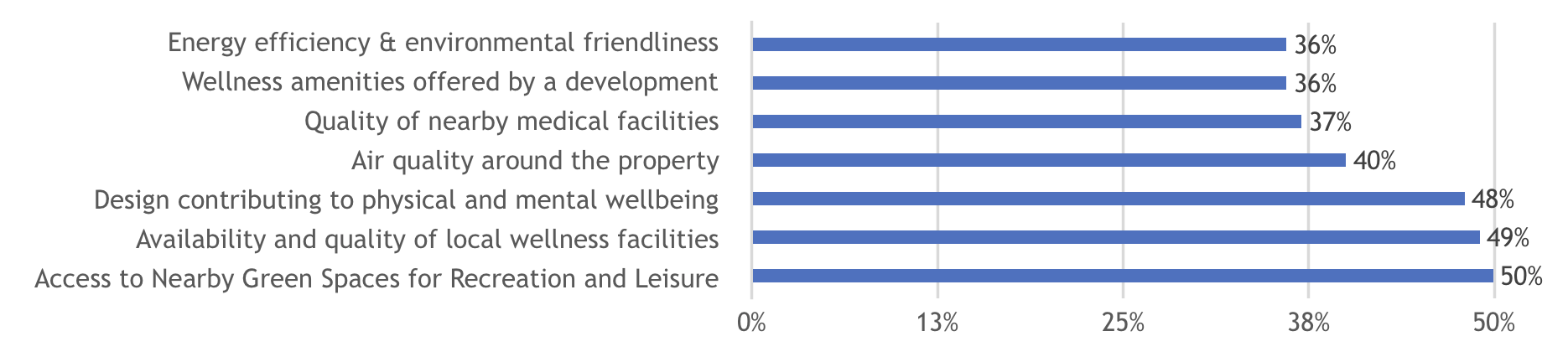

Now, looking at it from another perspective, what are the factors that drive the UHNWIs to purchase residential real estate? The results of the survey are as follows:

Figure 3 – Attributes Driving Residential Property Purchase

Source: The Wealth Report (2020 – 14th edition), Knight Frank

The importance of access to nearby green spaces for recreation and leisure can be seen followed by wellness facilities, and the property design which contributes to physical and mental wellbeing.

This could also be the result of Knight Frank targeting affluent clienteles.

This time, we covered residential real estate property price growth, the property size you can purchase with US$ 1 M, and attributes driving property purchases.

In the absence of data comparing the rate of global real estate price increases, using these datasets is an interesting way to get a snapshot of the trends in the world.

Covid-19 will definitely have an impact in the future so the results might vary but hopefully, this information will serve as a useful reference.