2021.09.07

コロナが東京の人口移動と不動産市場に与える影響

Due to the spread of COVID-19, individuals and companies have been trying to adapt to the new normal, such as the emphasis on remote work. Demand for single rooms in central Tokyo has been weakening, a bevy of shops and stores are temporarily or permanently with office vacancy rates rose to over 6% in July 2021. Let us also take a look at how the pandemic affects the population migration and whether there is a substantial impact on the housing market in Tokyo.

目次

Remote Work Leads to Slower Population Growth in Tokyo

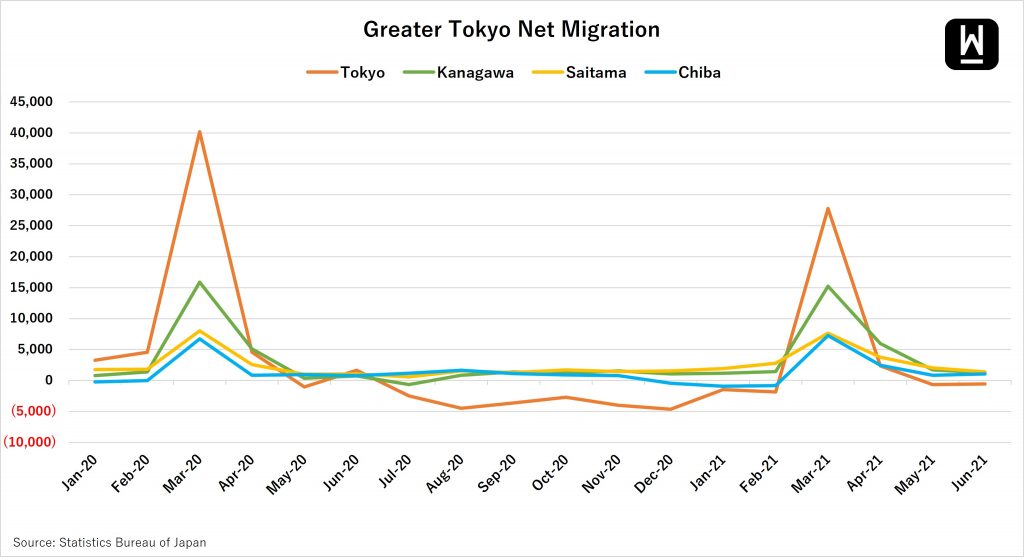

According to the data from the Statistics Bureau of Japan, while there was a swarm of immigrants to Tokyo before the start of the new season in April, mostly fresh graduates and students, the net migration of Tokyo between May 2020 and February 2021 were negative for the first time since July 2013.

Besides, on an annual basis, the net migration number of Tokyo dropped by around 50,000 in 2020 from a year ago. In contrast, Chiba rose, while Kanagawa, and Saitama changed little.

Being allowed to work remotely, more employees take the opportunity to move away from Tokyo to live in the suburbs, say in Chiba, where rent is cheaper, population density is lower. Even if they need to return to their office or visit clients in the city centre, they can take an express train to Tokyo.

Tokyo’s Housing Prices Continued to Soar

The data from Real Estate Information Network for East Japan show that during the first wave of pandemic, the transaction volume of existing properties in not only Tokyo but also the entire metropolitan area, including Kanagawa, Saitama, and Chiba, slumped between March and July 2020. The total transaction volume fell by 6% year-on-year in 2020. However, it is believed that with the sign of easing of the pandemic and the start of a new season, the substantial increase in the number of immigrants spurred the transaction volume in April and May 2021.

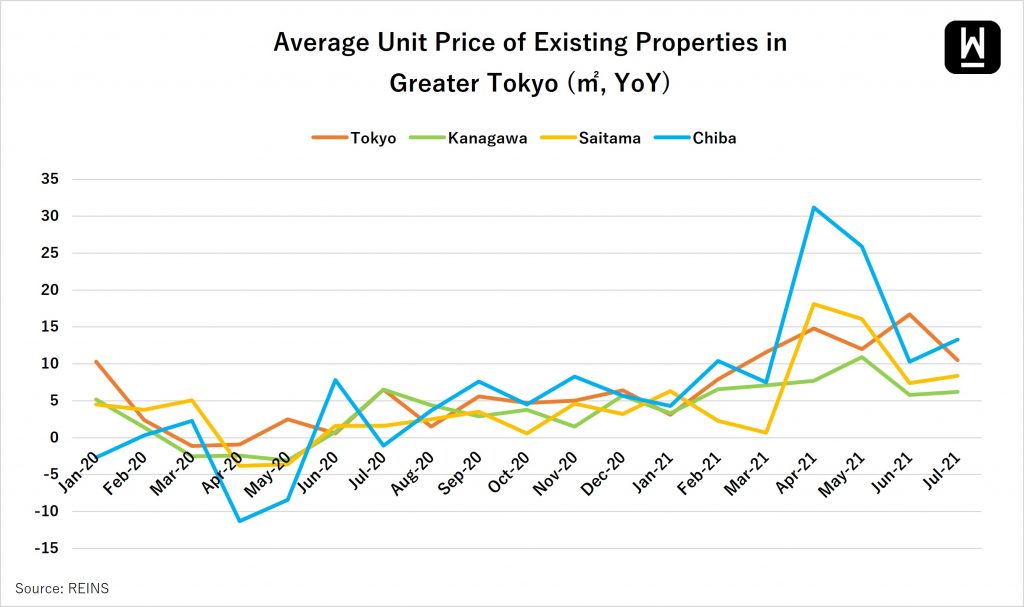

In terms of the housing price trends, we can see that the average unit price of existing properties in Tokyo fell in March and April 2020 and has been rising since then. That indicates that the stalling population growth of Tokyo has not led to the decline in housing prices in Tokyo. The rally of housing prices is likely due to the continuous decrease in supply. The number of new listings has continued declining every month since September 2019 in Tokyo and since March 2020 in Kanagawa and Chiba. The continuous short supply may be partly because homeowners are optimistic about the continued rise and are reluctant to sell. Average unit prices of existing properties in the metropolitan area have continued rising compared with last year since August 2020.

Although the Japanese government has set a goal for 70% of companies to implement remote work during the pandemic, less than 30% do so. It implies that the possibility of remote work becoming mainstream in Japan is not high. It is believed that the population growth of Tokyo will recover in the future, and if the supply continues to decline, the rally of housing prices in Tokyo may remain.

—

WealthPark is a real estate technology company that provides online and offline asset management services for overseas investors with properties in major cities of Japan, including Tokyo, Osaka, Yokohama, Nagoya, Kyoto, Fukuoka, and Sapporo.

WealthPark partners with real estate brokers and technology companies in order to provide investors with comprehensive asset management and property transaction services. WealthPark will continue to expand its digital platform to create user experience.

Contact Us: https://wealth-park.com/en/asset-management/#hsforms