2022.02.07

日本新築物件に投資する3つの理由

Investors of Japanese real estate opt to purchase existing properties to take advantage of lower purchase prices. With immaterial differences in rental yield, the return on investment of existing properties is perceived to be higher, making newly built ones less attractive.

This methodology evaluates the investment with only two considerations: rental income & purchase price, otherwise known as gross return, but overlooks multiple advantages of new builds that impact the net return that investors eventually put in their pockets.

目次

Fast Leasing Speed and High Occupancy Rate

Japanese renters bear a strong preference towards renting new builds, drastically reducing the vacancy risk and expediting the generation of rental income from the first tenant. In other words, the occupancy rate is a material factor that greatly affects the return of a property.

For example, let’s assume the rental yield of a newly built property is 6% and the occupancy rate is 100% compared with a 30-year-old existing property with a return of 8% and an occupancy rate of 70%. A simple calculation would show the adjusted rate of return for the newly built property to be 6% (6% x 100%), higher than that of the existing property of 5.6% (8% x 70%).

Low Maintenance Cost and Risk

New builds have newer infrastructures and are more resistant to earthquakes, so investors would not need to pay for major interior renovations and maintenance. In contrast, many existing properties have aged facilities and their renovation plans are not as meticulous as newly built ones, resulting in unexpected renovation works and high renovation costs.

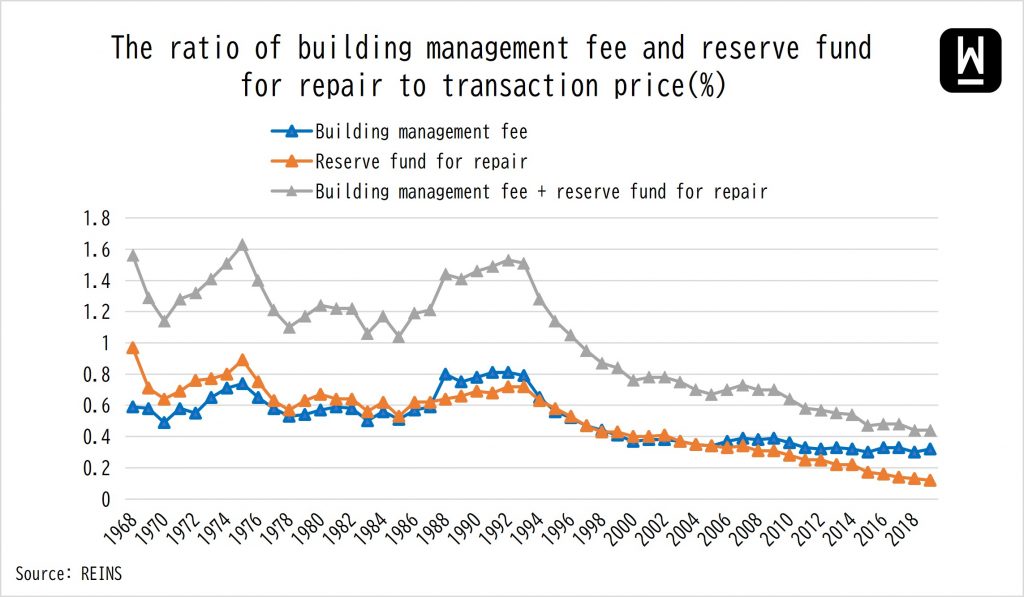

In addition, data from the Real Estate Information Network for East Japan show the ratio of building management fee and reserve fund for repair to transaction price increases when the property age increases, meaning that the newer the property, the lower the monthly cost ratio.

Higher Liquidity

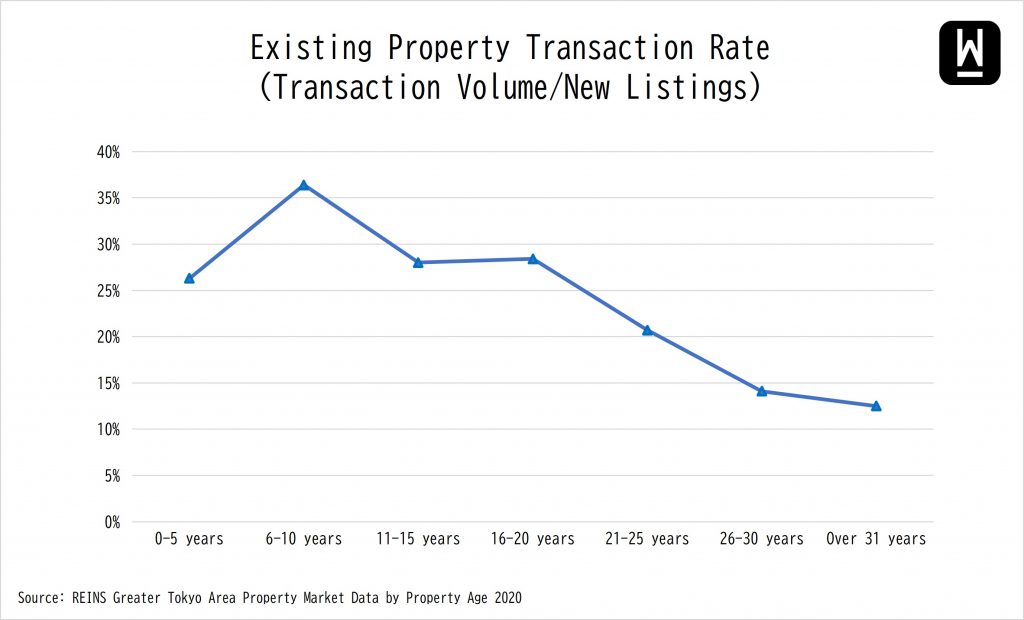

The data from Real Estate Information Network for East Japan also show that the closing rate of newer properties is higher than that of older ones. Not only are the newer properties fully furnished, but the contracts are also more detailed and reassuring than older ones, making them easier to find buyers, securing the exit for investors.

Although the prices of newly built properties in Japan are generally higher than that of existing ones, the cost of investing in a new property might be lower if you consider leverage. This is because banks have a higher appraisal value for newer properties and can lend at a higher LTV rate, while some older ones have lower appraisal values, are not approved for loans, or have a limited loan amount.

—

WealthPark RealEstate Technologies provides online and offline asset management services for overseas investors with properties in major cities of Japan, including Tokyo, Osaka, Yokohama, Nagoya, Kyoto, Fukuoka, and Sapporo.

WealthPark RET partners with real estate brokers, real estate developers and technology companies in order to provide investors with comprehensive asset management and property transaction services. WealthPark RET will continue to expand its digital platform to create user experiences.

Contact Us: https://wealth-park.com/en/asset-management/#hsforms